Airgain, Inc.

Minimum of Shares and Maximum of Shares of Common Stock

As confidentially submitted to the Securities and Exchange Commission on August 11, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Airgain, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| California (prior to reincorporation) Delaware (after reincorporation) |

3663 | 20-0281763 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130 USA

(760) 579-0200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Charles Myers

President and Chief Executive Officer

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

(760) 579-0200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Matthew T. Bush Cheston J. Larson Latham & Watkins LLP 12670 High Bluff Drive San Diego, CA 92130 Tel: (858) 523-5400 Fax: (858) 523-5450 |

Anna T. Pinedo James R. Tanenbaum Morrison & Foerster LLP 1290 Avenue of the Americas New York, NY 10104 Tel: (212) 468-8000 Fax: (212) 468-7900 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Aggregate |

Amount of Registration Fee(2) | ||

| Common stock, $0.0001 par value |

$ | |||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2014.

|

Airgain, Inc.

Minimum of Shares and Maximum of Shares of Common Stock |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.

| Page | ||||

| 1 | ||||

| 8 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

31 | |||

| 42 | ||||

| 53 | ||||

| 58 | ||||

| 75 | ||||

| 77 | ||||

| 79 | ||||

| 83 | ||||

| 85 | ||||

| 87 | ||||

| 94 | ||||

| 94 | ||||

| 94 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we and the selling stockholders may authorize to be delivered or made available to you. We have not, and the selling stockholders have not, authorized anyone to provide you with different information. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, operating results and prospects may have changed since that date.

For investors outside the United States: We, the selling stockholders or the underwriters have not done anything that would permit a public offering of the shares of our common stock or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Airgain, the Airgain logo, and other trademarks or service marks of Airgain appearing in this prospectus are the property of Airgain. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

i

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision in our common stock. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “our company” and “Airgain” refer to Airgain, Inc.

Our Company

Airgain is a leading provider of embedded antenna technology for the in-home wireless device market. Our innovative antenna systems open up exciting new possibilities in residential wireless services requiring design flexibility and reliable, whole-home wireless data and video coverage. Our antennas are found in end-user products that are deployed in carrier, enterprise, and residential wireless networks, including Wireless local area networking, also known as WLAN or Wi-Fi networking, access points, routers, residential gateways, set-top boxes, media adapters, and digital televisions. Our embedded antenna solutions are designed for easy integration into a variety of wireless devices, primarily those utilizing WLAN. Our significant experience in the design, integration, and testing of embedded antenna products has allowed us to become one of the leading providers in the residential WLAN antenna market. Driven by customer interest in alternative wireless connectivity technologies, we also provide our embedded antenna technology for adjacent data connectivity markets, including cellular, Long-Term Evolution, or LTE, and Digital Enhanced Cordless Telecommunications, or DECT, as well as high-performance designs for the in-building wireless market.

A Wi-Fi network allows various devices on a local area network, or LAN, to communicate with each other without the use of cabling or wiring. It adds the convenience of mobility to the powerful utility provided by high-speed data networks, and is a natural extension of broadband connectivity in the home and office. Wi-Fi technology was first utilized in applications such as computers and routers, and is now being embedded into other electronic devices, such as printers, digital cameras, gaming devices, PDAs, cellular phones and broadband modems. In addition, many new products are coming out with multiple wireless capabilities. As an example, tablets such as the Apple iPad come with Wi-Fi, Bluetooth, and cellular data capability. Each of these represents a separate radio technology, and each requires different antenna solutions to provide optimal performance.

We have a strong reputation with leading chipset vendors, Original Equipment Manufacturers, or OEMs, Original Design Manufacturers, or ODMs, telecommunications and broadband carriers and retail-focused customers. Our sales team, engineering leads, and executive management maintain relationships with key decision makers and engineering teams within this client value chain. Primarily distinguishing ourselves through early design, custom engineering support, and superior over-the-air, or OTA, testing capability, our design teams partner with customers in the early stages of antenna prototyping, testing, performance, and integration. We view OEMs and ODMs as strategic partners, while other antenna vendors do not engage directly with chipset vendors.

Providing custom support for antenna simulation, rapid prototyping, integration, and testing since 2004, we currently have approximately 150 antenna products in our portfolio. We shipped approximately 57 million antenna products in 2013 and supply our embedded antenna products to leading OEMs and ODMs worldwide. We have achieved significant growth in our business in a short period of time. From 2009 to 2013, our sales have grown from $3.6 million to over $25.4 million. Our income from operations has also increased from $0.1 million in 2012 to $1.6 million in 2013.

Our antenna products have been adopted by some of the world’s leading telecom manufacturers and networking companies, such as Actiontec Electronics, Inc., ARRIS Group, Inc., Belkin International, Inc., Cisco Systems, Inc., DIRECTV, LLC, EchoStar Corporation, Huawei Technologies Co., Ltd., Netgear, Inc., Pace plc, Sagemcom SAS and ZTE Corporation and are now being used by millions of carrier subscribers in the United States, Canada, Europe, and Asia.

Industry Background

We supply antennas that are part of the greater wireless communications industry. All wireless devices, from Wi-Fi routers to mobile handsets, require an antenna, or multiple antennas, in order to communicate with other devices. Antennas are the essential component in enabling wireless connectivity, and their design and application can dramatically impact throughput, range, and reliability in wireless devices.

Wireless communication is growing rapidly. When wireless communication was first introduced to the mass consumer market in the United States in the mid-1980s, the primary application was mobile voice services. However, wireless has rapidly evolved in terms of applications and technology. Along with the rapid growth of the internet, consumers have adopted newer uses for wireless devices including managing e-mail, online browsing and shopping, and running applications for business, personal productivity, and entertainment and media while on the go.

The most common form of wireless access is Wi-Fi, short for Wireless Fidelity. Wi-Fi is a standard established by the Institute of Electrical and Electronics Engineers, or IEEE, known technically as 802.11. The Wi-Fi standard is “the most ubiquitous wireless connectivity technology for internet access” according to ABI Research, a market intelligence firm. Over time, the 802.11 protocol has evolved to deliver higher and higher rates of data throughput, requiring more sophisticated devices. In addition, wireless networking has become increasingly mission-critical as businesses, schools, and government now find themselves providing Wi-Fi access as well. As more applications become cloud-based (meaning stored or run from remote servers), access to these services will become more vital. The boom in Wi-Fi hotspots necessitates sophisticated enterprise-class antennas as well, as these locations have high-traffic, high-bandwidth requirements for a large number of users in a small area.

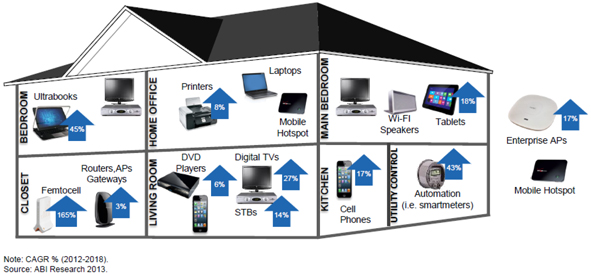

1

The rising demand for in-home wireless devices has helped to drive the embedded antenna market. According to ABI Research the number of Wi-Fi-enabled device shipments is expected to exceed 3.5 billion devices annually by 2018, representing a 15% compound annual growth rate, or CAGR, in this market since 2012. Some of the in-home devices that are increasingly being produced with Wi-Fi capabilities and which require smart antennas and embedded antennas capable of wireless audio and video distribution throughout the “connected home” include smart TVs, tablets, smartphones, music devices, set top boxes, residential gateways, smart thermostats, meters, and security alarms.

Our Core Strengths and Solutions

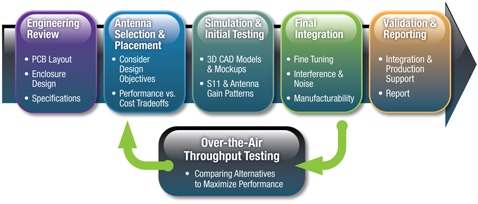

Our core competency is designing high-performance embedded antenna solutions, which has allowed us to become one of the leading providers in the in-home WLAN antenna market. Our customers generally choose to work with us because of our emphasis on testing, performance, and our ability to work within the design and engineering constraints of proposed and existing products. In certain cases, when we are engaged early in the design and specification phase of product development, we can make suggestions on how to improve performance by helping prospects and customers make changes to accommodate the selection and placement of an antenna, or antennas, within the early design and prototype stages.

| • | Design services and prototyping. We often become involved with customers in the design phase to provide input and help to ensure products perform well in the field. This starts with analyzing customer designs and devising prototype solutions that will meet the needs of customers. We do this iteratively with customers as required to create a custom solution. Our early stage design support centers on our proprietary AirMetric™ predictive antenna performance modeling solution which offers customers increased device performance and reduces product development time and costs. Using AirMetric™, we can identify the most promising antenna system through simulation and provide device manufacturers with design recommendations (e.g., box size and orientation, printed circuit board, or PCB, size, heat sink/shield locations and size, etc.) before devices are built. |

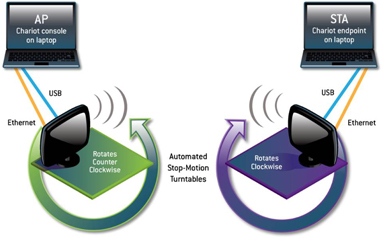

| • | Extensive Over-the-Air (OTA) testing. We have developed a set of proprietary performance metrics, measurement methodologies, and test conditions to enable measuring and predicting the relative OTA performance of 802.11-based WLAN routers, gateways, and set-top boxes. The purpose of this benchmark testing is to provide an accurate assessment of the performance characteristics of each device to enable buyers to make informed decisions in selecting the best antenna product for their needs. Our extensive OTA test process utilizes industry standard measurement tools and our proprietary implementation of the IEEE 802.11.2 Draft Recommended Practice for the Evaluation of 802.11 Wireless Performance. Our test methodology and process has become a leading industry standard for evaluating wireless performance in the WLAN space, and we supply testing tools and methodology to key customers and partners. These services are generally provided for free in order to generate goodwill with prospects. By providing this extra level of support, potential customers can see the difference in our solutions. |

| • | Product evolution and innovation. We employ engineers to continually develop better performing antennas for the benefit of customers. In addition, we spend time innovating to develop new designs and technologies that can be used for future customer needs. Over 50% of our employees are dedicated to engineering and design, with numerous Ph.D.s on staff. |

Our Opportunity

Our opportunity is being driven by the confluence of trends regarding how people access and use digital content within their homes and businesses.

| • | Growth of wireless devices. Over the past decade, wireless technologies such as cellular and Wi-Fi have emerged as mainstream networking platforms to connect people and data via devices. According to a February 2014 report from the Cisco Visual Networking Index, or the Cisco Report, the number of mobile-connected devices will exceed the world’s population by 2014. By 2018, there will likely be over 10 billion mobile and Machine-to-Machine, or M2M, devices, representing nearly 1.4 mobile devices per person on Earth. |

| • | Emerging whole home video market. Our business opportunity has been driven by the rapidly expanding market for embedded antenna solutions for in-home wireless data and video connectivity products. Wi-Fi has emerged as the key wireless technology for delivering media services in the connected home of the future, and the period from through 2018 is projected to have unabated mobile video adoption globally, despite macroeconomic conditions, according to the Cisco Report. |

2

| • | Increasing demand for mobile broadband. The demand for bandwidth has grown rapidly with the proliferation of sophisticated Wi-Fi-enabled devices. With ever increasing smartphone penetration rates and a host of new devices such as tablets, netbooks, mobile internet devices, or MIDs, and increasingly more powerful smartphones, the need for mobile broadband is at an all-time high and we believe is set to continue in demand and popularity. The Cisco Report predicts that mobile data traffic will expand at a CAGR of 61% through 2018, following a one-year growth rate of 81% in 2013. Over two-thirds of this bandwidth will be for video by 2018, which represented 53% of mobile data traffic in 2013. |

Risks Related to our Business

Our ability to implement our business strategy is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

| • | The market for our antenna products is developing and may not develop as we expect; |

| • | We have a history of losses, including an accumulated deficit of $45.2 million at March 31, 2014, and we may not be profitable in the future; |

| • | Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance; |

| • | Our products are subject to intense competition, and include competition from the customers to whom we sell, and competitive pressures from existing and new companies may harm our business, sales, growth rates and market share; |

| • | Our future success depends on our ability to develop and successfully introduce new and enhanced products for the wireless market that meet the needs of our customers; |

| • | Our business is characterized by short product development windows and short product lifecycles; |

| • | Any delays in our sales cycles could result in customers canceling purchases of our products; |

| • | We sell to customers who are extremely price conscious, and a limited number of customers represent a significant portion of our sales. If we were to lose any of these customers, our sales could decrease significantly; |

| • | We rely on a limited number of contract manufacturers to produce and ship all of our products, a single or limited number of suppliers for some of the components of our products and channel partners to sell and support our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products; |

| • | If we are unable to protect our intellectual property rights, our competitive position could be harmed or we could be required to incur significant expenses to enforce our rights; and |

| • | Our international sales and operations subject us to additional risks that can adversely affect our operating results and financial condition. |

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the JOBS Act. For as long as we are an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an emerging growth company until the earliest of:

| • | the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

| • | the last day of the fiscal year following the fifth anniversary of the closing of this offering; |

| • | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and |

| • | the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter). |

3

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We have elected to use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B).

Corporate Information

We were originally organized in 1995 as a California corporation under the name AM Group. The company was restructured in 2004 to focus exclusively on smart and embedded antenna technology, and we changed our name to Airgain, Inc. In connection with this offering, we plan to reincorporate in Delaware prior to closing of this offering. Our principal executive offices are located at 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130, and our telephone number is (760) 579-0200. Our website address is www.airgain.com. Information contained in, or accessible through, our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

4

THE OFFERING

| Common stock we are offering |

shares | |

| Common stock offered by the selling stockholders |

shares (assuming the maximum number of shares are sold) | |

| Common stock to be outstanding after this offering |

shares | |

| Use of proceeds |

We estimate that the net proceeds from this offering, after deducting the estimated underwriters’ commissions and estimated offering expenses payable by us, will be approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and assuming the minimum amount is sold. We will not receive any proceeds from the sale of shares by the selling stockholders. We intend to use the net proceeds of this offering for working capital and general corporate purposes, including sales and marketing activities, product development, and capital expenditures. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| Risk Factors |

You should read the “Risk Factors” section of this prospectus and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| Proposed NASDAQ symbol |

“AIRG” | |

The number of shares of our common stock to be outstanding after this offering is based on 37,007,131 shares of our common stock outstanding as of March 31, 2014 after giving effect to the automatic conversion of all outstanding shares of our preferred stock as of March 31, 2014 into an aggregate of 30,592,230 shares of common stock, and excludes:

| • | 5,120,500 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2014, at a weighted average exercise price of $0.24 per share; |

| • | 8,582,414 shares of our common stock issuable upon the exercise of warrants outstanding as of March 31, 2014, at a weighted average exercise price of $1.05 per share; and |

| • | unallocated shares of common stock reserved for future issuance under our stock-based compensation plans, consisting of 1,334,760 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan as of March 31, 2014, which shares will be added to the shares to be reserved under our 2014 Incentive Award Plan, shares of common stock to be reserved for future issuance under our 2014 Incentive Award Plan, which will become effective in connection with this offering, and shares of common stock to be reserved for future issuance under our 2014 Employee Stock Purchase Plan, which will become effective in connection with this offering, and shares that become available under our 2014 Incentive Award Plan and 2014 Employee Stock Purchase Plan pursuant to provisions thereof that automatically increase the share reserves under the plans each year, as more fully described in “Executive Compensation—Incentive Award Plans.” |

Except as otherwise indicated, all information in this prospectus assumes the following:

| • | our reincorporation in Delaware prior to the closing of this offering; |

| • | the approval and filing of an amendment to our existing articles of incorporation to eliminate the payout of accrued preferred stock dividends in connection with this offering; |

| • | the filing of our Delaware certificate of incorporation and adoption of our amended and restated bylaws prior to the closing of this offering; |

| • | the automatic conversion of all outstanding shares of our preferred stock into 30,592,230 shares of our common stock prior to the closing of this offering; and |

| • | no exercise of the outstanding options or warrants described above. |

5

SUMMARY FINANCIAL DATA

The following tables set forth a summary of our historical financial data as of, and for the periods ended on, the dates indicated. We have derived the statements of operations data for the years ended December 31, 2012 and 2013 from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the three months ended March 31, 2013 and 2014 and the balance sheet data as of March 31, 2014 have been derived from our unaudited financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited financial statements. In the opinion of the management, the unaudited data reflects all adjustments, consisting of normal and recurring adjustments, necessary for a fair presentation of results as of and for these periods. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the sections in this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not indicative of our future results.

| Year Ended | Three Months Ended | |||||||||||||||

| December 31, 2012 |

December 31, 2013 |

March 31, 2013 |

March 31, 2014 |

|||||||||||||

| (unaudited) | ||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||

| Sales |

$ | 18,197,063 | $ | 25,392,286 | $ | 5,148,205 | $ | 6,362,612 | ||||||||

| Cost of goods sold |

11,520,325 | 15,379,416 | 3,193,731 | 3,518,169 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

6,676,738 | 10,012,870 | 1,954,474 | 2,844,443 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

2,481,122 | 3,142,316 | 744,393 | 824,454 | ||||||||||||

| Sales and marketing |

2,302,387 | 3,035,648 | 645,956 | 996,958 | ||||||||||||

| General and administrative |

1,783,543 | 2,234,566 | 664,995 | 1,205,222 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

6,567,052 | 8,412,530 | 2,055,344 | 3,026,634 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

109,686 | 1,600,340 | (100,870 | ) | (182,191 | ) | ||||||||||

| Interest and other expense (income) |

1,196,061 | 1,424,484 | 874,423 | (1,811,728 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

(1,086,375 | ) | 175,856 | (975,293 | ) | 1,629,537 | ||||||||||

| Provision for income taxes |

800 | 10,800 | — | (357 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | (1,087,175 | ) | $ | 165,056 | $ | (975,293 | ) | $ | 1,629,894 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders(1) |

||||||||||||||||

| Basic |

$ | (0.85 | ) | $ | (0.60 | ) | $ | (0.42 | ) | $ | 0.23 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (1.08 | ) | $ | (0.60 | ) | $ | (0.42 | ) | $ | (0.04 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding used in computing net income (loss) per share attributable to common stockholders(1) |

||||||||||||||||

| Basic |

3,785,661 | 3,785,716 | 3,785,661 | 4,412,162 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

3,785,661 | 3,785,716 | 3,785,661 | 4,412,162 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(1) |

||||||||||||||||

| Weighted average shares outstanding used in computing pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(1) |

||||||||||||||||

| (1) | See Note 1 to our financial statements included elsewhere in this prospectus for an explanation of the method used to calculate the historical and pro forma net loss per share, basic and diluted, and the number of shares used in the computation of the per share amounts. |

6

| As of March 31, 2014 | ||||||||||||

| Balance Sheet Data: | Actual | Pro Forma(1) | Pro Forma As Adjusted(2) |

|||||||||

| (unaudited) | ||||||||||||

| Cash and cash equivalents |

$ | 2,473,110 | $ | $ | ||||||||

| Working capital |

2,352,190 | |||||||||||

| Total assets |

7,586,932 | |||||||||||

| Preferred stock warrant liability |

1,802,307 | |||||||||||

| Long-term notes payable |

551,995 | |||||||||||

| Preferred redeemable convertible stock |

39,108,686 | |||||||||||

| Preferred convertible stock |

5,968,549 | |||||||||||

| Additional paid-in capital |

— | |||||||||||

| Accumulated deficit |

(45,199,527 | ) | ||||||||||

| Total stockholders’ deficit |

(38,214,195 | ) | ||||||||||

| (1) | Gives effect to (a) the automatic conversion of all outstanding shares of our preferred stock into 30,592,230 shares of our common stock prior to the closing of this offering, and (b) the resultant reclassification of our preferred stock warrant liability to additional paid-in capital, a component of stockholders’ deficit |

| (2) | Gives further effect to our issuance and sale of shares of common stock in this offering by us at the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriters’ commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, total assets, additional paid-in capital and total stockholders’ deficit by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriters’ commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ deficit by approximately $ million. The pro forma information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing. |

7

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our common stock. The occurrence of any of the events or developments described below could harm our business, financial condition, operating results, and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to Our Business and Industry

The market for our antenna products is developing and may not develop as we expect.

The market for our antenna products, and specifically the Wi-Fi market, is developing and may not develop as we expect. We believe our future success will depend in large part on the growth in the market for Wi-Fi devices that provide in-home wireless data connectivity for internet and video distribution. It is difficult to predict customer adoption and renewal rates, customer demand for our antennas, the size and growth rate of this market, the entry of competitive products, or the success of existing competitive products. Any expansion in our market depends on a number of factors, including the cost, performance, and perceived value associated with our antennas. If our antenna products do not achieve widespread adoption or there is a reduction in demand for antennas in our market caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders, early order cancellations, or decreased sales, any of which would adversely affect our business, operating results and financial condition.

We have a history of losses, and we may not be profitable in the future.

Before 2013, we had incurred net losses in each year since our inception, including a net loss of $1.1 million in 2012. As a result, we had an accumulated deficit of $45.2 million at March 31, 2014. Because the market for our antenna products is rapidly evolving, it is difficult for us to predict our operating results. We expect our operating expenses to increase over the next several years as we hire additional personnel, particularly in engineering, sales, and marketing, and continue to develop new antenna products to address new and evolving markets. In addition, as we grow and as we become a newly public company, we will incur additional significant legal, accounting, and other expenses that we did not incur as a private company. If our sales do not increase to offset these increases in our operating expenses, we may not be profitable in future periods. Our historical sales growth has been inconsistent and should not be considered indicative of our future performance. Any failure to sustain or increase our profitability on a consistent basis could cause the value of our common stock to materially decline.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance.

Our quarterly and annual operating results have fluctuated in the past and may fluctuate significantly in the future, which makes it difficult for us to predict our future operating results. The timing and size of sales of our products are variable and difficult to predict and can result in fluctuations in our net sales from period to period. In addition, our budgeted expense levels depend in part on our expectations of future sales. Because any substantial adjustment to expenses to account for lower levels of sales is difficult and takes time, we may not be able to reduce our costs sufficiently to compensate for an unexpected shortfall in net sales, and even a small shortfall in net sales could disproportionately and adversely affect our operating margin and operating results for a given quarter.

Our operating results may also fluctuate due to a variety of other factors, many of which are outside of our control, including the changing and volatile U.S., European, Asian and global economic environments, and any of which may cause our stock price to fluctuate. In addition to other risks listed in this “Risk Factors” section, factors that may affect our operating results include:

| • | fluctuations in demand for our products and services; |

| • | the inherent complexity, length and associated unpredictability of product development windows and product lifecycles; |

| • | changes in customers’ budgets for technology purchases and delays in their purchasing cycles; |

| • | changing market conditions; |

| • | any significant changes in the competitive dynamics of our markets, including new entrants, or further consolidation; |

| • | the timing of product releases or upgrades by us or by our competitors; and |

| • | our ability to develop, introduce and ship in a timely manner new products and product enhancements and anticipate future market demands that meet our customers’ requirements. |

The cumulative effects of these factors could result in large fluctuations and unpredictability in our quarterly and annual operating results. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of future performance.

8

Our products are subject to intense competition, and include competition from the customers to whom we sell.

Antenna solutions is an established technical field that has low intellectual property and technological barriers to entry. Antenna competition exists globally for all areas of our business and our product lines. The markets in which we compete are intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. The markets are influenced by, among others, brand awareness and reputation, price, strength and scale of sales and marketing efforts, professional services and customer support, product features, reliability and performance, scalability of products, and breadth of product offerings. Due to the proprietary nature of our products, competition occurs primarily at the design stage. As a result, a design win by our competitors or by us typically limits further competition with respect to a given design. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and failure to increase, or the loss of, market share, any of which would likely seriously harm our business, operating results or financial condition. From a cost and control perspective, our products generally cost more than our competitor’s products and add a degree of complexity to an OEM and ODM product planning and manufacturing process. If our ability to design antenna solutions is deemed to be on par or of lesser value than competing solutions, we could lose our customers and prospects.

New entrants and the introduction of other distribution models in our markets may harm our competitive position.

The markets for development, distribution, and sale of our products are rapidly evolving. New entrants seeking to gain market share by introducing new technology and new products may make it more difficult for us to sell our products, and could create increased pricing pressure, reduced profit margins, increased sales and marketing expenses, or the loss of market share or expected market share, any of which may significantly harm our business, operating results and financial condition.

Historically, large, integrated telecommunications equipment suppliers controlled access to the wireless broadband infrastructure equipment and network management software that could be used to extend the geographic reach of wireless internet networks. However, in recent years, network operators and service providers have been able to purchase wireless broadband infrastructure equipment and purchase and implement network management applications from distributors, resellers, and OEMs and ODMs. Increased competition from providers of wireless broadband equipment may result in fewer vendors providing complementary equipment, which could harm our business and sales. Broadband equipment providers or system integrators may also offer wireless broadband infrastructure equipment for free or as part of a bundled offering, which could force us to reduce our prices or change our selling model to remain competitive. If there is a major shift in the market such that network operators and service providers begin to use closed network solutions that only operate with other equipment from the same vendor, we could experience a significant decline in sales because our products would not be interoperable with these proprietary standards.

Our future success depends on our ability to develop and successfully introduce new and enhanced products for the wireless market that meet the needs of our customers.

Our sales depends on our ability to anticipate our existing and prospective customers’ needs and develop products that address those needs. Our future success will depend on our ability to introduce new products for the wireless market, anticipate improvements and enhancements in wireless technology and wireless standards, and to develop products that are competitive in the rapidly changing wireless industry. Introduction of new products and product enhancements will require coordination of our efforts with those of our customers, suppliers, and manufacturers to rapidly achieve volume production. If we fail to coordinate these efforts, develop product enhancements or introduce new products that meet the needs of our customers as scheduled, our operating results will be materially and adversely affected and our business and prospects will be harmed. We cannot assure that product introductions will meet the anticipated release schedules or that our wireless products will be competitive in the market. Furthermore, given the emerging nature of the wireless market, there can be no assurance our products and technology will not be rendered obsolete by alternative or competing technologies.

Our business is characterized by short product development windows and short product lifecycles.

Our solutions are purchased and integrated by customers in the electronics industry. In many cases, the products that include our solutions are subject to short product development windows and short product lifecycles. In the case of the short product development window, we may be pressured to provide solutions that are the lowest in cost in order to be accepted. Customer pressure could force us to reduce our price in order to win designs that have short development windows. With respect to short product lifecycles, it is possible that we will provide up-front design and engineering work, but ultimately lose the design to a competitor, or even if we do win the design, such design could be extremely short-lived due to our customer’s inability to sell the product in significant volume. Our up-front costs associated with a design can be significant, and if the volumes are inadequate due to lack of acceptance and/or short lifecycle, our financial performance will be impaired.

Any delays in our sales cycles could result in customers canceling purchases of our products.

Sales cycles for some of our products can be lengthy, often lasting several months to a year or longer. In addition, it can take additional time before a customer commences volume production of equipment that incorporates our products. Sales cycles can be lengthy for a number of reasons, including:

| • | our original equipment manufacturer, or OEM, customers and carriers usually complete a lengthy technical evaluation of our products, over which we have no control, before placing a purchase order; |

9

| • | the commercial introduction of our products by OEM customers and carriers is typically limited during the initial release to evaluate product performance; and |

| • | the development and commercial introduction of products incorporating new technologies frequently are delayed. |

A significant portion of our operating expense is relatively fixed and is based in large part on our forecasts of volume and timing of orders. The lengthy sales cycles make forecasting the volume and timing of product orders difficult. In addition, the delays inherent in lengthy sales cycles raise additional risks of customer decisions to cancel or change product phases. If customer cancellations or product changes were to occur, this could result in the loss of anticipated sales without sufficient time for us to reduce our operating expenses. In addition, although we currently do not maintain significant inventories, we may in the future establish significant inventory levels to meet forecasted future demand. If the forecasted demand does not materialize into purchase orders for these products, we may be required to write off our inventory balances or reduce the value of our inventory, based on a reduced sales price. A write off of the inventory, or a reduction in the inventory value due to a sales price reduction, could have an adverse effect on our financial condition and operating results.

A limited number of customers represent a significant portion of our sales. If we were to lose any of these customers, our sales could decrease significantly.

In 2013, our top three customers accounted for approximately 17%, 16% and 16% of sales, respectively. Although our top customers that pay for our products are often ODMs and distributors, it is primarily the OEMs, carrier customers and retail-focused end-customers that drive the use of our antenna solutions and the purchase by the ODMs and distributors of our antenna solutions. Any significant loss of, or a significant reduction in purchases by, these, other significant customers or customers that drive the use of our antenna solutions could have an adverse effect on our financial condition and operating results.

We sell to customers who are extremely price conscious.

Our customers compete in segments of the electronics market. The electronics market is characterized by intense competition as companies strive to come to market with innovative designs that attract customers based upon design, performance, cost, ease of use, and convenience. Product lifecycles can be extremely short as companies try to gain advantage over their competitors. Because of the high design and engineering costs, companies that are customers or prospects for antenna solutions are extremely cost conscious. As a result, our customers and prospects demand price cuts in established products, and negotiate aggressively for lower pricing on new products. Because of the intense competition in the antenna solution market, we encounter situations that lead to difficult price negotiations potentially resulting in lower margins than forecast.

We rely on a limited number of contract manufacturers to produce and ship all of our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products.

We rely on two contract manufacturers, which are located in China, to manufacture, control quality of, and ship our products. We do not have long-term contracts with these manufacturers that commit them to manufacture products for us. Any significant change in our relationship with these manufacturers could have a material adverse effect on our business, operating results, and financial condition. We make substantially all of our purchases from our contract manufacturers on a purchase order basis. Our contract manufacturers are not required to manufacture our products for any specific period or in any specific quantity. We expect that it would take approximately six to nine months to transition manufacturing, quality assurance, and shipping services to new providers. Relying on contract manufacturers for manufacturing, quality assurance, and shipping also presents significant risks to us, including the inability of our contract manufacturers to:

| • | qualify appropriate component suppliers; |

| • | manage capacity during periods of high demand; |

| • | meet delivery schedules; |

| • | assure the quality of our products; |

| • | ensure adequate supplies of materials; |

| • | protect our intellectual property; and |

| • | deliver finished products at agreed-upon prices. |

We may experience delays in obtaining product from manufacturers and may not be a high priority for our manufacturers.

The ability and willingness of our contract manufacturers to perform is largely outside of our control. We believe that our orders may not represent a material portion of our contract manufacturers’ total orders and, as a result, fulfilling our orders may not be a priority in the event our contract manufacturers are constrained in their abilities or resources to fulfill all of their customer obligations in a timely manner. If any of our contract manufacturers suffers an interruption in its business, experiences delays,

10

disruptions, or quality control problems in its manufacturing operations or we have to change or add additional contract manufacturers, our ability to ship products to our customers would be delayed and our sales could become volatile and our cost of sales may increase.

Our contract manufacturers purchase some components, subassemblies and products from a single or limited number of suppliers. The loss of any of these suppliers may substantially disrupt our ability to obtain orders and fulfill sales as we design in and qualify new components.

We rely on third-party components and technology to build and operate our products, and we rely on our contract manufacturers to obtain the components, subassemblies, and products necessary for the manufacture of our products. Shortages in components that we use in our products are possible, and our ability to predict the availability of such components is limited. If shortages occur in the future, as they have in the past, our business, operating results and financial condition would be materially adversely affected. Unpredictable price increases of such components due to market demand may occur. While components and supplies are generally available from a variety of sources, we and our contract manufacturers currently depend on a single or limited number of suppliers for several components for our products. If our suppliers of these components or technology were to enter into exclusive relationships with other providers of wireless networking equipment or were to discontinue providing such components and technology to us and we were unable to replace them cost effectively, or at all, our ability to provide our products would be impaired. Additionally, poor quality in any of the single or limited sourced components in our products could result in lost sales or lost sales opportunities. We and our contract manufacturers generally rely on purchase orders rather than long-term contracts with these suppliers. As a result, even if available, we and our contract manufacturers may not be able to secure sufficient components at reasonable prices or of acceptable quality to build our products in a timely manner. Therefore, we may be unable to meet customer demand for our products, which would have a material adverse effect on our business, operating results, and financial condition.

We rely significantly on channel partners to sell and support our products, and the failure of this channel to be effective could materially reduce our sales.

Our indirect channel partners, which include value added resellers, distributors, engineering design companies and outside sales representatives, accounted for 49% of our sales in 2013. We believe that establishing and maintaining successful relationships with these channel partners is, and will continue to be, important to our financial success. Recruiting and retaining qualified channel partners and training them in our technology and product offerings require significant time and resources. To develop and expand our channel, we must continue to scale and improve our processes and procedures that support our channel partners, including investment in systems and training.

Existing and future channel partners will only work with us if we are able to provide them with competitive products on terms that are commercially reasonable to them. If we fail to maintain the quality of our products or to update and enhance them, existing and future channel partners may elect to work instead with one or more of our competitors. In addition, the terms of our arrangements with our channel partners must be commercially reasonable for both parties. If we are unable to reach agreements that are beneficial to both parties, then our channel partner relationships will not succeed.

We have no minimum purchase commitments with any of our channel partners, and our contracts with channel partners do not prohibit them from offering products or services that compete with ours, including products they currently offer or may develop in the future and incorporate into their own systems. Some of our competitors may have stronger relationships with our channel partners than we do and we have limited control, if any, as to whether those partners use our products, rather than our competitors’ products, or whether they devote resources to market and support our competitors’ products, rather than our offerings.

The reduction in or loss of sales by these channel partners could materially reduce our sales. If we fail to maintain relationships with our channel partners, fail to develop new relationships with other channel partners in new markets, fail to manage, train or incentivize existing channel partners effectively, fail to provide channel partners with competitive products on terms acceptable to them, or if these channel partners are not successful in their sales efforts, our sales may decrease and our operating results could suffer.

Defects in our products or poor design and engineering services could result in lost sales and subject us to substantial liability.

Our antenna solutions are a critical element in determining the operating performance of our customers’ products. If our antenna solutions perform poorly, whether due to design, engineering, placement or other reasons, we could lose sales. In certain cases, if our antenna solution is found to be the component that leads to failure or a failure to meet the performance specifications of our customer, we could be required to pay monetary damages to our customer. Real or perceived defects or errors in our antenna solutions could result in claims by channel partners and customers for losses that they sustain. If channel partners or customers make these types of claims, we may be required, or may choose, for customer relations or other reasons, to expend additional resources in order to help correct the problem, including warranty and repair costs, process management costs and costs associated with remanufacturing our inventory. Liability provisions in our standard terms and conditions of sale may not be enforceable under some circumstances or may not fully or effectively protect us from claims and related liabilities and costs. In addition, regardless of the party at fault, errors of these kinds divert the attention of our engineering personnel from our product development efforts, damage our

11

reputation and the reputation of our products, cause significant customer relations problems and can result in product liability claims. We maintain insurance to protect against certain types of claims associated with the use of our products, but our insurance coverage may not adequately cover any such claims. In addition, even claims that ultimately are unsuccessful could result in expenditures of funds in connection with litigation and divert management’s time and other resources. We also may incur costs and expenses relating to a recall of one or more of our products. The process of identifying recalled products that have been widely distributed may be lengthy and require significant resources, and we may incur significant replacement costs, contract damage claims from our customers and significant harm to our reputation. The occurrence of these problems could result in the delay or loss of market acceptance of our products and could adversely affect our business, operating results and financial condition.

The loss of key personnel or an inability to attract, retain and motivate qualified personnel may impair our ability to expand our business.

Our success depends upon the continued service and performance of our senior management team and key technical, marketing and production personnel, including Charles Myers, who is our President and Chief Executive Officer. The replacement of any members of our senior management team or other key employees or consultants likely would involve significant time and costs and may significantly delay or prevent the achievement of our business objectives.

Our future success also depends, in part, on our ability to continue to attract, integrate and retain highly skilled personnel. Competition for highly skilled personnel is frequently intense. Any difficulties in obtaining or retaining human resource competencies that we need to achieve our business objectives may have an adverse effect on our performance.

We are subject to the risk that third-party consultants will not perform their tasks effectively and that we will be unsuccessful in operating our business as a result.

We rely on third parties, such as a sales consultants and engineering contractors, for a portion of the design and sales and marketing of our products. The engineering contractors typically work directly with our design team but are employed by our contract manufacturers in China. We rely on these third parties in addition to our own employees to perform the daily tasks necessary to operate our business in these areas and cannot ensure that third-party consultants will be able to complete their work for us in a timely manner. Accordingly, our reliance on third parties exposes us to the risk that our business will be unsuccessful if they do not design and sell our product as expected.

Future acquisitions could disrupt our business and adversely affect our operating results, financial condition, and cash flows.

We have not completed any acquisitions. However, we may choose to expand by making acquisitions that could be material to our business, operating results, financial condition, and cash flows. If we pursue an acquisition strategy, we may not be able to find suitable acquisition candidates, and we may not be able to complete such acquisitions on favorable terms, if at all. If we do complete acquisitions, we may not ultimately strengthen our competitive position or achieve our goals, and any acquisitions we complete could be viewed negatively by our end-customers, investors and financial analysts. Our ability as an organization to acquire and integrate technologies or businesses successfully is unproven. Acquisitions involve many risks. An acquisition may negatively affect our operating results, financial condition or cash flows because it may require us to incur charges or assume substantial debt or other liabilities, may cause adverse tax consequences or unfavorable accounting treatment, may expose us to claims and disputes by third parties, including intellectual property claims and disputes, or may not generate sufficient financial return to offset additional costs and expenses related to the acquisition.

Unanticipated changes in our effective tax rate could harm our future results.

Because we have a history of losses before 2013, we have paid non-substantial amounts of federal and state taxes. As of December 31, 2013, we had a net operating loss carryforward for federal income tax purposes of $28.0 million, which if unutilized will expire between 2021 and 2031. At December 31, 2013, we had a net operating loss carryforward for state income tax purposes of $23.8 million, which if unutilized will expire between 2014 and 2031. In addition, we have federal research and development tax credit carryforwards of approximately $1.3 million as of December 31, 2013, which if unutilized will expire between 2026 and 2033. We also have state research and development tax credit carryforwards of approximately $1.0 million at December 31, 2013, which may be available to reduce future state regular income taxes, if any, over an indefinite period. These tax credits are subject to examination by state and federal taxing authorities and may need to be revised as a result of any exam.

If tax rules and regulations change, and we are not able to apply these carryforwards, we may be forced to pay taxes at a rate and time prior to what is currently possible today. Pursuant to an analysis of Section 382 of the Internal Revenue Code, as amended, completed in May 2014, our ability to utilize NOLs is limited to $23.0 million for federal income tax purposes and $22.2 million for state income tax purposes as of December 31, 2013.

12

Our election to not opt out of the extended accounting transition period under the Jumpstart Our Business Startups Act of 2012, or the Jobs Act, may make our financial statements difficult to compare to other companies.

Pursuant to the JOBS Act, as an emerging growth company, we can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the Public Company Accounting Oversight Board or the SEC. We have elected not to opt out of such extended transition period. This means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, are permitted to use any extended transition period for adoption that is provided in the new or revised accounting standard having different application dates for public and private companies. This may make the comparison of our financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

If we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected. In addition, because of our status as an emerging growth company, you will not be able to depend on any attestation from our independent registered public accounting firm as to our internal control over financial reporting for the foreseeable future.

When we become a reporting company, the Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and controls over financial reporting. In particular, as a public company, we will be required to perform system and process evaluations and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. We will be required to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting for the first fiscal year beginning after the effective date of this offering. However, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act until the later of the year following our first annual report required to be filed with the SEC or the date we are no longer an “emerging growth company” as defined in the JOBS Act. Accordingly, you will not be able to depend on any attestation concerning our internal control over financial reporting from our independent registered public accounting firm for the foreseeable future.

We have identified a material weakness and significant deficiencies in our internal control over financial reporting in the past. Our failure to establish and maintain effective internal control over financial reporting could result in our failure to meet our reporting obligations and cause investors to lose confidence in our reported financial information, which in turn could cause the trading price of our common stock to decline.

In connection with the audits of our financial statements as of the year ended December 31, 2011 we became aware of a material weakness in our internal control over financial reporting. A material weakness is defined as a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected and corrected on a timely basis. The material weakness pertained to deficiencies in the calculation of preferred stock warrant liability, which led to an overstatement of the liability. We did not have adequate controls in place to account for preferred stock warrant liability properly.

In connection with the audits of our financial statements as of the year ended December 31, 2012 and 2013 we became aware of significant deficiencies in our internal control over financial reporting. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance.

We believe that we have taken the measures necessary to address the underlying causes of the material weakness and significant deficiencies. However, if our remedial measures are insufficient to address the material weakness and significant deficiencies, or if significant deficiencies or material weaknesses in our internal control over financial reporting are discovered or occur in the future, it may adversely affect the results of our management evaluations and, when required, annual auditor attestation reports regarding the effectiveness of our internal control over financial reporting required by Section 404 of the Sarbanes-Oxley Act of 2002. In addition, if we are unable to produce accurate and timely financial statements or we are required to restate our financial results, our stock price may be adversely affected.

Compliance with environmental matters and worker health and safety laws could be costly, and noncompliance with these laws could have a material adverse effect on our operating results, expenses and financial condition.

Some of our operations use substances regulated under various federal, state, local and international laws governing the environment and worker health and safety, including those governing the discharge of pollutants into the ground, air and water, the management and disposal of hazardous substances and wastes, and the cleanup of contaminated sites. Some of our products are subject to various federal, state, local and international laws governing chemical substances in electronic products. We could be subject to increased costs, fines, civil or criminal sanctions, third-party property damage or personal injury claims if we violate or become liable under environmental and/or worker health and safety laws.

13

Our business is subject to the risks of earthquakes, fire, floods and other natural catastrophic events.

Our corporate headquarters are located in Southern California, and our two contract manufacturers are located in eastern Asia, both regions known for seismic activity. A significant natural disaster, such as an earthquake, a fire or a flood, occurring near our headquarters, or near the facilities of our contract manufacturers, could have a material adverse impact on our business, operating results and financial condition.

The terms of our amended and restated loan and security agreement place restrictions on our operating and financial flexibility. If we raise additional capital through debt financing, the terms of any new debt could further restrict our ability to operate our business.

We have a $3.0 million revolving credit facility and a $750,000 growth capital term loan and security agreement with Silicon Valley Bank that is secured by a lien covering substantially all of our properties, rights and assets, excluding intellectual property. As of March 31, 2014, the revolving credit facility was undrawn, and the outstanding principal balance of the growth capital term loan was $750,000. The loan and security agreement contains customary affirmative and negative covenants and events of default applicable to us and any subsidiaries, if any. The affirmative covenants include, among others, covenants requiring us (and us to cause our subsidiaries) to maintain our legal existence and governmental approvals, deliver certain financial reports, maintain insurance coverage, keep inventory, if any, in good and marketable condition and protect material intellectual property. The negative covenants include, among others, restrictions on us and our subsidiaries transferring collateral, incurring additional indebtedness, engaging in mergers or acquisitions, paying dividends or making other distributions, making investments, creating liens, selling assets and making any payment on subordinated debt, in each case subject to certain exceptions. If we default under the facility, the lender may accelerate all of our repayment obligations and take control of our pledged assets, potentially requiring us to renegotiate our agreement on terms less favorable to us or to immediately cease operations. Further, if we are liquidated, the lender’s right to repayment would be senior to the rights of the holders of our common stock to receive any proceeds from the liquidation. The lender could declare a default upon the occurrence of any event that it interprets as a material adverse effect as defined under the credit facility, thereby requiring us to repay the loan immediately or to attempt to reverse the declaration of default through negotiation or litigation. Any declaration by the lender of an event of default could significantly harm our business and prospects and could cause the price of our common stock to decline. If we raise any additional debt financing, the terms of such additional debt could further restrict our operating and financial flexibility.

If we are unable to manage our growth and expand our operations successfully, our business and operating results will be harmed and our reputation may be damaged.

We have expanded our operations significantly since inception and anticipate that further significant expansion will be required to achieve our business objectives. The growth and expansion of our business and product offerings places a continuous and significant strain on our management, operational and financial resources. Any such future growth would also add complexity to and require effective coordination throughout our organization. To date, we have used the services of third-parties to perform tasks including design and sales and marketing. Our growth strategy may entail expanding our group of contractors or consultants to implement these tasks going forward. Because we rely on consultants, effectively outsourcing key functions of our business, we will need to be able to manage these consultants to ensure that they successfully carry out their contractual obligations and meet expected deadlines. However, if we are unable to effectively manage our outsourced activities or if the quality of the services provided by consultants is compromised for any reason, our ability to provide quality products in a timely manner could be harmed, which may have a material adverse effect on our business operating results and financial condition.

To manage any future growth effectively, we must continue to improve and expand our information technology and financial infrastructure, our operating and administrative systems and controls, and our ability to manage headcount, capital and processes in an efficient manner. We may not be able to successfully implement improvements to these systems and processes in a timely or efficient manner, which could result in additional operating inefficiencies and could cause our costs to increase more than planned. If we do increase our operating expenses in anticipation of the growth of our business and this growth does not meet our expectations, our operating results may be negatively impacted. If we are unable to manage future expansion, our ability to provide high quality products and services could be harmed, which could damage our reputation and brand and may have a material adverse effect on our business, operating results and financial condition.

Our business, operating results and growth rates may be adversely affected by current or future unfavorable economic and market conditions.