DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on May 14, 2018

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.1)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Airgain, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Table of Contents

EXPLANATORY NOTE

Airgain, Inc. is filing this Amendment No. 1 to Schedule 14A (the Amendment No. 1) to amend and restate in its entirety the definitive proxy statement of the Company for the 2018 annual meeting of stockholders, which was filed with the Securities and Exchange Commission on April 27, 2018 (the Original Filing).

The purpose of this Amendment No. 1 is primarily to reflect events occurring after the date of the Original Filing and to update disclosures throughout the definitive proxy statement that may have been affected by such subsequent events, including: (i) the resignation of Charles Myers, our President and Chief Executive Officer and member of our board of directors, or Board, on May 2, 2018 and the subsequent appointment of James K. Sims, our Chairman of the Board, as our interim Chief Executive Officer, (ii) Board and Board committee changes following such management changes; and (iii) updated executive compensation as a result of the such management changes. Except for the revisions specifically discussed above, this Amendment No. 1 does not otherwise materially modify or update any other disclosures presented in the Original Filing.

You should read this Amendment No. 1 in its entirety and in place of the Original Filing. We will print and distribute to our stockholders this Amendment No. 1 in lieu of the Original Filing. The changes to update disclosures in this Amendment No. 1 were discovered prior to printing and mailing the definitive proxy statement contained in the Original Filing.

Table of Contents

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

Dear Stockholder:

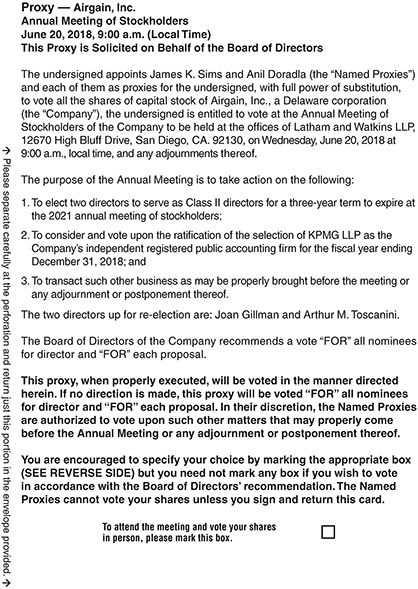

The annual meeting of stockholders of Airgain, Inc. will be held at the offices of Latham & Watkins LLP, located at 12670 High Bluff Drive, San Diego, CA 92130 on June 20, 2018 at 9:00 a.m., local time, for the following purposes:

| 1. | To elect two directors to serve as Class II directors for a three-year term to expire at the 2021 annual meeting of stockholders; |

| 2. | To consider and vote upon the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| 3. | To transact such other business as may be properly brought before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the attached proxy statement, which forms a part of this notice and is incorporated herein by reference. Our board of directors has fixed the close of business on April 24, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

Accompanying this notice is a proxy card. Whether or not you expect to attend our annual meeting, please complete, sign and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card. If you plan to attend our annual meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.

| By Order of the Board of Directors, |

| /s/ James K. Sims |

| James K. Sims |

| Interim Chief Executive Officer and Chairman of the Board |

San Diego, California

May 14, 2018

Your vote is important. Please vote your shares whether or not you plan to attend the meeting.

Table of Contents

| Page | ||||

| 1 | ||||

| 5 | ||||

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

16 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

18 | |||

| 20 | ||||

| 28 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

i

Table of Contents

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

PROXY STATEMENT FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, JUNE 20, 2018

The board of directors of Airgain, Inc. is soliciting the enclosed proxy for use at the annual meeting of stockholders to be held at the offices of Latham & Watkins LLP, located at 12670 High Bluff Drive, San Diego, CA 92130, on June 20, 2018 at 9:00 a.m., local time. If you need directions to the location of the annual meeting, please contact us at (760) 579-0200.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 20, 2018

This proxy statement and our Annual Report on Form 10-K are available electronically at www.proxydocs.com/AIRG.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the 2018 annual meeting of stockholders. This proxy statement summarizes information related to your vote at the annual meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting in person. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card.

We intend to begin mailing this proxy statement, the attached notice of annual meeting and the enclosed proxy card on or about May 14, 2018 to all stockholders of record entitled to vote at the annual meeting. Only stockholders who owned our common stock on April 24, 2018 are entitled to vote at the annual meeting. On this record date, there were 9,442,794 shares of our common stock outstanding. Common stock is our only class of stock entitled to vote.

What am I voting on?

There are two proposals scheduled for a vote:

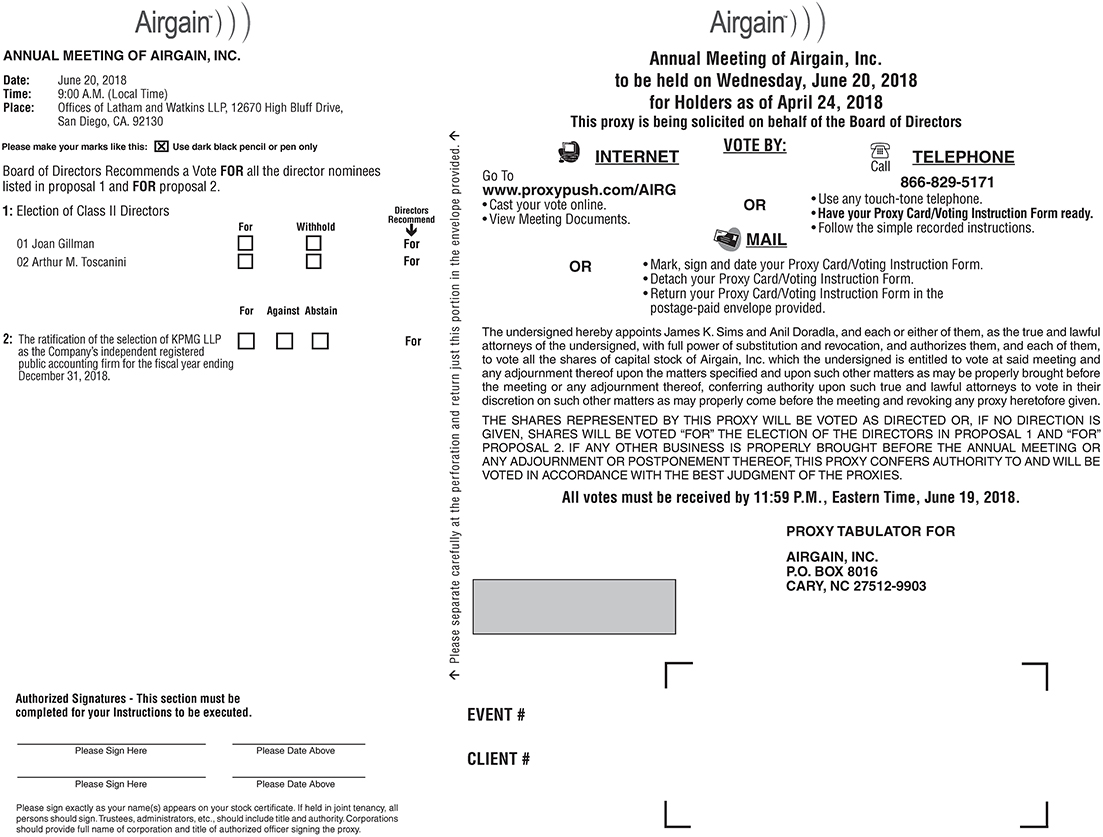

Proposal 1: To elect two directors to serve as Class II directors for a three-year term.

Proposal 2: To consider and vote upon the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2018.

How many votes do I have?

Each share of our common stock that you own as of April 24, 2018 entitles you to one vote.

1

Table of Contents

How do I vote by proxy?

With respect to the election of directors, you may either vote For all of the nominees to the board of directors or you may Withhold your vote for any nominee you specify. With respect to the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, you may vote For, Against or Abstain from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted.

| | By Mail: You may vote using your proxy card by completing, signing, dating and returning the proxy card in the self-addressed, postage-paid envelope provided. If you properly complete your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your shares, as permitted, will be voted as recommended by our board of directors. If any other matter is presented at the annual meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the meeting, other than those discussed in this proxy statement. |

| | Via the Internet: You may vote at www.proxypush.com/AIRG, 24 hours a day, seven days a week. Have your proxy card available when you access the website and use the Control Number shown on your proxy card. Votes submitted via the Internet must be received by 11:59 p.m., Eastern Time, on June 19, 2018. |

| | By Telephone: You may vote using a touch-tone telephone by calling (866) 829-5171, 24 hours a day, seven days a week. Have your proxy card available when you call and use the Control Number shown on your proxy card. Votes submitted by telephone must be received by 11:59 p.m., Eastern Time, on June 19, 2018. |

| | In Person: You may still attend the meeting and vote in person even if you have already voted by proxy. To vote in person, come to the annual meeting and we will give you a ballot at the annual meeting. |

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Generally, you have three options for returning your proxy.

| | By Mail: You may vote by signing, dating and returning your voting instruction card in the pre-addressed envelope provided by your broker, bank or other agent. |

| | By Method Listed on Voting Instruction Card: Please refer to your voting instruction card or other information provided by your bank, broker or other agent to determine whether you may vote by telephone or electronically on the Internet, and follow the instructions on the voting instruction card or other information provided by your broker, bank or other agent. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank, broker or other agent does not offer Internet or telephone voting information, please complete and return your voting instruction card in the self-addressed, postage-paid envelope provided. |

| | In Person: To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request the proxy form authorizing you to vote the shares. |

2

Table of Contents

| You will need to bring with you to the annual meeting the legal proxy form from your broker, bank or other agent authorizing you to vote the shares as well as proof of identity. |

May I revoke my proxy?

If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the three following ways:

| | you may send in another signed proxy with a later date, |

| | you may authorize a proxy again on a later date on the Internet (only the latest Internet proxy submitted prior to the annual meeting will be counted), or |

| | you may notify our corporate secretary, Anil Doradla, in writing before the annual meeting that you have revoked your proxy, after which you are entitled to submit a new proxy or vote in person at the meeting. |

What constitutes a quorum?

The presence at the annual meeting, in person or by proxy, of holders representing a majority of our outstanding common stock as of April 24, 2018, or approximately 4,721,397 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election of Directors. The two nominees who receive the most For votes (among votes properly cast in person or by proxy) will be elected. Only votes For or Withhold will affect the outcome.

Proposal 2: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of KPMG LLP must receive For votes from the holders of a majority in voting power of the votes cast affirmatively or negatively on the proposal. Only votes For or Against will affect the outcome.

Voting results will be tabulated and certified by the inspector of election appointed for the annual meeting.

What is the effect of withheld votes, abstentions and broker non-votes?

Shares of common stock held by persons attending the annual meeting but not voting, and shares represented by proxies that reflect withheld votes or abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. Abstentions are not an affirmative or negative vote on a proposal, so abstaining does not count as a vote cast and has no effect for purposes of determining whether our stockholders have ratified the appointment of KPMG LLP, our independent registered public accounting firm. The election of directors is determined by a plurality of votes cast, so a Withhold vote will not be counted in determining the outcome of such proposal.

Shares represented by proxies that reflect a broker non-vote will be counted as present for purposes of determining the presence of a quorum exists. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. With regard to the election of directors, broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. However, ratification of the appointment of KPMG LLP is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

3

Table of Contents

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officers and other employees may solicit proxies in person or by mail, telephone, fax or email. We will not pay our directors, officers and other employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Our costs for forwarding proxy materials will not be significant.

How do I obtain an Annual Report on Form 10-K?

If you would like a copy of our Annual Report on Form 10-K for the year ended December 31, 2017 that we filed with the Securities and Exchange Commission, or the SEC, on March 15, 2018, we will send you one without charge. Please write to:

Airgain, Inc.

3611 Valley Centre Drive, Suite 150

San Diego, CA 92130

Attn: Corporate Secretary

All of our SEC filings are also available free of charge in the InvestorsSEC Filings section of our website at www.airgain.com.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

4

Table of Contents

ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class of our directors standing for election each year, generally for a three-year term. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires and hold office until the third annual meeting following election and until such directors successor is elected and qualified, or until such directors earlier death, resignation or removal. On January 31, 2018, Francis X. Egan resigned from our board of directors. As a result of Mr. Egans resignation, our board of directors consisted of two Class I directors, one Class II director and three Class III directors. As our amended and restated certificate of incorporation provides that each class of directors shall consist, as nearly as possible, of one-third of the total number of directors constituting the entire board of directors, the board of directors determined that Joan Gillman be moved to Class II. Ms. Gillman was formerly a Class III director with a term expiring at our 2019 annual meeting of stockholders. On May 2, 2018, Charles Myers resigned as our President and Chief Executive Officer and as a member of our board of directors. Mr. Myers was a Class I director. Following Mr. Myers resignation, effective as of May 8, 2018, pursuant to our amended and restated bylaws, our board of directors reduced the size of the board from seven to five directors. As detailed in the section below, our current composition of our board of directors is as follows: Class I consists of James K. Sims; Class II consists of Joan Gillman and Arthur M. Toscanini; and Class III consists of Frances Kordyback and Thomas A. Munro.

At this meeting, two nominees for director are to be elected as Class II directors for a three-year term expiring at our 2021 annual meeting of stockholders and until their successors are duly elected and qualified. The nominees, who were recommended for nomination by the nominating and corporate governance committee of our board of directors, are Joan Gillman and Arthur M. Toscanini. The Class I director has two years remaining on his term of office and the Class III directors have one year remaining on their terms of office.

If no contrary indication is made, proxies in the accompanying form are to be voted for Ms. Gillman and Mr. Toscanini, or in the event that Ms. Gillman or Mr. Toscanini is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our board of directors to fill the vacancy. Each of Ms. Gillman and Mr. Toscanini is currently a member of our board of directors.

All of our directors bring to the board of directors significant leadership experience derived from their professional experience and service as executives or board members of other corporations and/or private equity and venture capital firms. The process undertaken by the nominating and corporate governance committee in recommending qualified director candidates is described below under Director Nomination Process. Certain individual qualifications and skills of our directors that contribute to the board of directors effectiveness as a whole are described in the following paragraphs.

Information Regarding Directors

The information set forth below as to the directors and nominees for director has been furnished to us by the directors and nominees for director:

Nominees for Election to the Board of Directors

For a Three-Year Term Expiring at the

2021 Annual Meeting of Stockholders (Class II)

| Name |

Age | Present Position with Airgain, Inc. |

||||

| Joan Gillman |

54 | Director | ||||

| Arthur M. Toscanini |

75 | Director | ||||

5

Table of Contents

Joan Gillman has served on our board of directors since November 2016. Ms. Gillman has served as Executive Vice President and Chief Operating Officer of Time Warner Cable Media from September 2006 to June 2016. She first joined Time Warner Cable as a new product and marketing consultant in January 2004 and served from May 2005 to September 2006 as Vice President of Interactive TV and Advanced Advertising. Prior to Time Warner Cable, Ms. Gillman served in senior executive roles at OpenTV Corporation, British Interactive Broadcasting Holdings Limited and Physicians Online Inc. She has also held two of the top senior roles in the Office of U.S. Senator Chris Dodd, State Director and Legislative Director. Ms. Gillman currently serves on the board of directors of Centrica PLC, InterDigital (IDCC) and The Jesuit Volunteer Corp. She has previously served on the board of directors of various private companies, industry associations, and not-for-profits, including the College of the Holy Cross, The CityParks Foundation, National Cable Communications (NCC) LLC and the Interactive Advertising Bureau (IAB). Ms. Gillmans extensive experience as an operating executive in the cable and technology industries, as well as her service as a director of numerous public and private companies, contributed to our board of directors conclusion that she should serve as a director of our company.

Arthur M. Toscanini has served on our board of directors since 2005. Mr. Toscanini is the Chief Financial Officer of GEN3 Partners, a position he has held since 2000. Prior to GEN3 Partners, he was with Cambridge Technology Partners from 1991 to 2000, where he served as the Chief Financial Officer. Mr. Toscanini also served as Vice President and Controller of Concurrent Computer Corporation from 1986 to 1991. Prior to Concurrent Computer Corporation, he worked at Perkin-Elmer Data Systems Group. Mr. Toscanini currently serves on the board of directors of EPAY Systems. He holds a B.A. in accounting from Pace University and an M.A. in management from Monmouth University. Mr. Toscaninis extensive knowledge of our business and experience as a chief financial officer contributed to our board of directors conclusion that he should serve as a director of our company.

Members of the Board of Directors Continuing in Office

Term Expiring at the

2020 Annual Meeting of Stockholders (Class I)

| Name |

Age | Present Position with Airgain, Inc. |

||||

| James K. Sims |

71 | Chairman of the Board of Directors and interim Chief Executive Officer | ||||

James K. Sims has served as our chairman of the board of directors since November 2003 and as our interim Chief Executive Officer since May 2, 2018. Mr. Sims has served as the Chairman and Chief Executive Officer of GEN3 Partners, a consulting company that specializes in science-based technology development, since 1999, and as Managing Partner of its affiliated private equity investment fund, GEN3 Capital, LLP, since 2005. In 2017, Mr. Sims was the founding partner of Silicon Valley Data Capital. Mr. Sims founded Silicon Valley Data Science (SVDS) in 2012 where he is currently the Chairman. Mr. Sims also founded Cambridge Technology Partners in 1991 where he held the position of Chief Executive Officer. Prior to Cambridge Technology Partners, Mr. Sims also founded Concurrent Computer Corporation. Mr. Sims currently serves on the board of directors of various private companies including EPAY Systems, Inc., where he is currently the Chairman of the Board, Connections 365, Inc. and Bright Volt, Inc. and has previously served on the board of

6

Table of Contents

directors of public companies including Cambridge Technology Partners, RSA Security, Inc., where he was the Chairman, and Electronic Data Systems Corporation. Mr. Sims extensive experience as a director of numerous public and private companies, as well as his extensive experience as a founder and venture capital investor in the technology industry, contributed to our board of directors conclusion that he should serve as a director of our company.

Term Expiring at the

2019 Annual Meeting of Stockholders (Class III)

| Name |

Age | Present Position with Airgain, Inc. |

||||

| Frances Kordyback |

64 | Director | ||||

| Thomas A. Munro |

61 | Director | ||||

Frances Kordyback has served on our board of directors since November 2005. Ms. Kordyback is a Commissioner with the Ontario Securities Commission, a position she has held since November 2016. Ms. Kordyback previously served as a Managing Director of Northwater Capital Management Inc., a position she held from January 2005 through September 2016. Prior to Northwater Capital Management, she served as the Managing Director of CCFL Parklea Capital Inc. from January 2003 to December 2004.

Ms. Kordyback was a partner in Plaxton & Co. Limited from February 1999 to December 2001. Ms. Kordyback also serves on the board of directors of the Ontario Securities Commission. Ms. Kordyback holds a Bachelor of Mathematics from the University of Waterloo. Ms. Kordybacks experience as a venture capitalist investing in the technology industry and her governance and regulatory experience contributed to our board of directors conclusion that she should serve as a director of our company.

Thomas A. Munro has served on our board of directors since 2004. Mr. Munro is the Chief Executive Officer of Verimatrix, Inc., an Internet security technology company, a position he has held since April 2005. Prior to Verimatrix, Mr. Munro was the President of Wireless Facilities from 2001 to 2003 and Chief Financial Officer from 1997 to 2001. Previously, he was the Chief Financial Officer of Precision Digital Images from 1994 to 1995 and MetLife Capital Corporation from 1992 to 1994. Mr. Munro currently serves on the board of directors of BandwidthX, Inc., a private company, and previously served on the board of directors of private companies Kineticom, Inc. and CommNexus. Mr. Munro holds a B.A. in business and an M.B.A. from the University of Washington. Mr. Munros extensive knowledge of our business and history and experience in the wireless technology industry contributed to our board of directors conclusion that he should serve as a director of our company.

Board Independence

Our board of directors has determined that all our directors are independent directors within the meaning of the applicable Nasdaq Stock Market LLC, or Nasdaq, listing standards, except for James K. Sims, who is no longer an independent director effective as of his appointment as our interim Chief Executive Officer. Following the appointment of a permanent Chief Executive Officer, we expect that all of our current members of the board of directors will be independent.

Board Leadership Structure

Our board of directors is currently led by its chairman, James K. Sims. Our board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the company continues to grow.

Prior to the resignation of Charles Myers as our Chief Executive Officer and as a member of our board of directors, we separated the roles of chief executive officer and chairman of the board of directors in recognition of the differences between the two roles. In connection with Mr. Myers resignation, Mr. Sims was appointed as our interim Chief Executive Officer and continues to serve as the chairman of our board of directors. Although these changes resulted in us combining the roles of chairman and chief executive officer, our board of directors determined that this leadership structure is optimal because it provides our company with the ability to maintain experience and leadership through this transaction period. Our board of directors believes that it is appropriate for Mr. Sims to continue in his role as chairman of the board of directors until we find a permanent Chief Executive Officer. In the event the board of directors appoints a permanent Chief Executive Officer to replace Mr. Sims in that role, the board of directors will reassess these roles and the board leadership structure. No independent director serves as the lead independent director. We believe that each of our independent directors brings valuable experience, oversight and expertise from outside our Company.

7

Table of Contents

Our board of directors has concluded that our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Our board of directors has responsibility for the oversight of the companys risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board of directors to understand the companys risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board of directors as a whole.

Board of Directors Meetings

During fiscal year 2017, our board of directors met five times, including telephonic meetings. In that year, each director attended at least 75% of the total number of meetings held during such directors term of service by the board of directors and each committee of the board of directors on which such director served.

Board Committees

Our board of directors has established three standing committeesaudit, compensation and nominating and corporate governance each of which operates under a charter that has been approved by our board of directors.

Audit Committee

The audit committees main function is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committees responsibilities include, among other things:

| | appointing our independent registered public accounting firm; |

| | evaluating the qualifications, independence and performance of our independent registered public accounting firm; |

| | approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

| | reviewing the design, implementation, adequacy and effectiveness of our internal accounting controls and our critical accounting policies; |

8

Table of Contents

| | discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements; |

| | reviewing, overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| | reviewing on a periodic basis, or as appropriate, any investment policy and recommending to our board of directors any changes to such investment policy; |

| | reviewing any earnings announcements and other public announcements regarding our results of operations; |

| | preparing the report that the SEC requires in our annual proxy statement; |

| | reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics; and |

| | reviewing and evaluating, at least annually, the performance of the audit committee and its members including compliance of the audit committee with its charter. |

The members of our audit committee are Ms. Gillman, Ms. Kordyback and Mr. Toscanini. Mr. Toscanini serves as the chairperson of the committee. The audit committee met six times during fiscal year 2017. Mr. Munro served as a member of the committee until April 2017, at which time Ms. Kordyback joined the committee. Our board of directors has determined that all of the members of the audit committee are independent directors under the applicable rules and regulations of Nasdaq and by Rule 10A-3 of Securities and Exchange Act of 1934, as amended, or the Exchange Act, and our board of directors previously determined that Mr. Munro was an independent director under such qualification standards during his term of service on the audit committee. In addition, all members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq. Our board of directors has determined that Mr. Toscanini is an audit committee financial expert as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq rules and regulations. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq.

Both our external auditor and internal financial personnel meet privately with the audit committee and have unrestricted access to this committee.

Compensation Committee

Our compensation committee approves, or recommends to our board of directors, policies relating to compensation and benefits of our officers and employees. The compensation committee approves, or recommends to our board of directors, corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives and approves, or recommends to our board of directors, the compensation of these officers based on such evaluations. The compensation committee also approves, or recommends to our board of directors, the issuance of stock options and other awards under our equity plan. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter.

The members of our compensation committee are Mr. Munro and Mr. Toscanini. Mr. Munro serves as the chairperson of the committee. The compensation committee met once during fiscal year 2017. Ms. Gillman served as a member of the committee through April 2017, at which time Mr. Egan joined the committee. Mr. Egan served as a member of the committee until his resignation in January 2018. Mr. Sims served as a member of the committee until he assumed the role of interim Chief Executive Officer on May 2, 2018. Our board of directors has determined that all of the members of the compensation committee are independent under the applicable rules and regulations of The Nasdaq Capital Market relating to compensation committee independence. The compensation committee operates under a written charter, which the compensation committee will review and evaluate at least annually.

9

Table of Contents

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for assisting our board of directors in discharging the boards responsibilities regarding the identification of qualified candidates to become board members, the selection of nominees for election as directors at our annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected), and the selection of candidates to fill any vacancies on our board of directors and any committees thereof. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies, reporting and making recommendations to our board of directors concerning governance matters and oversight of the evaluation of our board of directors.

The members of our nominating and corporate governance committee are Ms. Gillman, and Mr. Munro. Ms. Gillman serves as the chairperson of the committee. Mr. Sims served as a member of the committee until he assumed the role of interim Chief Executive Officer on May 2, 2018. The nominating and corporate governance committee met once during fiscal year 2017. Our board of directors has determined that all members of the nominating and corporate governance committee are independent under the applicable rules and regulations of Nasdaq. The nominating and corporate governance committee operates under a written charter, which the nominating and corporate governance committee will review and evaluate at least annually.

Report of the Audit Committee of the Board of Directors

The audit committee oversees the companys financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the companys annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed with KPMG LLP, which is responsible for expressing an opinion on the conformity of the companys audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the companys accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards and the matters listed in Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees. In addition, the audit committee has discussed with KPMG LLP, its independence from management and the company, has received from KPMG LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLPs communications with the audit committee concerning independence, and has considered the compatibility of non-audit services with the auditors independence.

The audit committee met with KPMG LLP to discuss the overall scope of its services, the results of its audit and reviews, and the overall quality of the companys financial reporting. KPMG LLP, as the companys independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the companys reporting. The audit committees meetings with KPMG LLP were held with and without management present. The audit committee is not employed by the company, nor does it provide any expert assurance or professional certification regarding the companys financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the companys independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the companys board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2017. The audit committee and the companys board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of KPMG LLP as the companys independent registered public accounting firm for 2018.

10

Table of Contents

This report of the audit committee is not soliciting material, shall not be deemed filed with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

| Respectfully submitted,

|

| The Audit Committee of the Board of Directors |

| Arthur M. Toscanini (chairman) |

| Joan Gillman |

| Frances Kordyback |

Compensation Committee Interlocks and Insider Participation

Thomas A. Munro (chairperson), Francis X. Egan, Joan Gillman and James K. Sims served on our compensation committee during the 2017 fiscal year. With the exception of Mr. Sims, who assumed the role of interim Chief Executive Officer on May 2, 2018, none of the members of our compensation committee during the 2017 fiscal year has ever been one of our officers or employees. None of our executive officers currently serves, or has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Director Nomination Process

Director Qualifications

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, will take into account many factors, including the following:

| | personal and professional integrity, ethics and values; |

| | experience in corporate management, such as serving as an officer or former officer of a publicly-held company; |

| | experience as a board member or executive officer of another publicly-held company; |

| | strong finance experience; |

| | diversity of expertise and experience in substantive matters pertaining to our business relative to other members of our board of directors; |

| | diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience; |

| | experience relevant to our business industry and with relevant social policy concerns; and |

| | relevant academic expertise or other proficiency in an area of our business operations. |

11

Table of Contents

Currently, our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating and corporate governance committee may also consider such other factors as it may deem to be in the best interests of our company and our stockholders. The nominating and corporate governance committee does, however, believe it appropriate for at least one, and preferably, several, members of our board of directors to meet the criteria for an audit committee financial expert as defined by SEC rules, and that a majority of the members of our board of directors meet the definition of independent director under Nasdaq qualification standards.

Identification and Evaluation of Nominees for Directors

The nominating and corporate governance committee identifies nominees for director by first evaluating the current members of our board of directors willing to continue in service. Current members with qualifications and skills that are consistent with the nominating and corporate governance committees criteria for board of director service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our board of directors with that of obtaining a new perspective or expertise.

If any member of our board of directors does not wish to continue in service or if our board of directors decides not to re-nominate a member for re-election or if the board of directors decides to expand the size of the board, the nominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. The nominating and corporate governance committee generally polls our board of directors and members of management for their recommendations. The nominating and corporate governance committee may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The nominating and corporate governance committee reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by the members of the nominating and corporate governance committee and by certain of our other independent directors and executive management. In making its determinations, the nominating and corporate governance committee evaluates each individual in the context of our board of directors as a whole, with the objective of assembling a group that can best contribute to the success of our company and represent stockholder interests through the exercise of sound business judgment. After review and deliberation of all feedback and data, the nominating and corporate governance committee makes its recommendation to our board of directors. Historically, the nominating and corporate governance committee has not relied on third-party search firms to identify director candidates. The nominating and corporate governance may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

The nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. We have not received director candidate recommendations from our stockholders, and we do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by members of our board of directors, management or other parties are evaluated.

Under our amended and restated bylaws, a stockholder wishing to suggest a candidate for director should write to our corporate secretary and provide such information about the stockholder and the proposed candidate as is set forth in our amended and restated bylaws and as would be required by SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. In order to give the nominating and corporate governance committee sufficient time to evaluate a recommended candidate and include the candidate in our proxy statement for the 2018 annual meeting, the recommendation should be received by our corporate

12

Table of Contents

secretary at our principal executive offices in accordance with our procedures detailed in the section below entitled Stockholder Proposals.

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directors at our annual meeting, we encourage all of our directors to attend. Two members of our Board of Directors attended our annual meeting of stockholders in 2017.

Communications with our Board of Directors

Stockholders seeking to communicate with our board of directors should submit their written comments to our corporate secretary, Airgain, Inc., 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130. The corporate secretary will forward such communications to each member of our board of directors; provided that, if in the opinion of our corporate secretary it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion).

Corporate Governance

Our companys Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter and Nominating and Corporate Governance Committee Charter are available, free of charge, on our website at www.airgain.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide copies of these documents as well as our companys other corporate governance documents, free of charge, to any stockholder upon written request to Airgain, Inc., 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130.

Director Compensation

Our board of directors has approved a compensation policy for our non-employee directors. The non-employee director compensation policy provides for annual retainer fees and long-term equity awards for our non-employee directors. Pursuant to the terms of the non-employee director compensation policy, each non-employee director will receive an annual retainer of $30,000, with an additional $25,000 annual retainer payable to the chairman of the board of directors. Non-employee directors serving as the chairs of the audit, compensation and nominating and corporate governance committees will receive additional annual retainers of $15,000, $10,000 and $7,500, respectively. Non-employee directors serving as members of the audit, compensation and nominating and corporate governance committees will receive additional annual retainers of $7,500, $5,000 and $3,750, respectively.

Each non-employee director will also receive an initial grant of options to purchase 10,000 shares of our common stock upon election to the board of directors, vesting in substantially equal installments on each of the first three anniversaries of the date of grant. Until January 17, 2018, each non-employee director also received an annual grant of options to purchase 5,000 shares of our common stock, with the chairman of the board of directors receiving an additional option to purchase 2,500 shares of our common stock, vesting on the first to occur of the first anniversary of the date of grant or the next occurring annual meeting of our stockholders.

Effective January 17, 2018, the board of directors amended our non-employee director compensation policy to revise the annual equity awards to non-employee directors. Effective January 19, 2018, the board of directors awarded each non-employee director stock options to purchase 15,000 shares of our common stock (with Mr. Sims receiving stock options to purchase 20,000 shares of our common stock in recognition of his service as chairman of the board), which awards will vest on the first anniversary of the date of grant and were granted in lieu of the annual grants that would have been granted at the time of the 2018 annual meeting of stockholders under the non-employee director compensation policy in effect prior to January 17, 2018. Commencing in 2019, each non-employee director will receive an annual award on the first trading day in February of each year of a number of stock options having a

13

Table of Contents

value of $60,000 (with the award to the chairman of the board having a value of $90,000), calculated as of the date of grant in accordance with the Black-Scholes option pricing model (utilizing the same assumptions that we use in preparation of our financial statements and the 30-day trailing average trading price of our common stock preceding the date of grant), which annual awards will vest on the first anniversary of the date of grant.

Compensation under our non-employee director compensation policy is subject to the annual limits on non-employee director compensation set forth in our 2016 Incentive Award Plan, referred to herein as the 2016 Plan. Our board of directors or its authorized committee may modify the non-employee director compensation program from time to time in the exercise of its business judgment, taking into account such factors, circumstances and considerations as it shall deem relevant from time to time, subject to the annual limit on non-employee director compensation set forth in the 2016 Plan. As provided in the 2016 Plan, our board of directors or its authorized committee may make exceptions to this limit for individual non-employee directors in extraordinary circumstances, as the board of directors or its authorized committee may determine in its discretion, provided that the non-employee director receiving such additional compensation may not participate in the decision to award such compensation or in other compensation decisions involving non-employee directors.

Mr. Myers, who served as our Chief Executive Officer until May 2, 2018, received no compensation for his service as a director. The compensation received by Mr. Myers during 2017 as an employee is presented in Executive CompensationSummary Compensation Table.

The following table sets forth information for the year ended December 31, 2017 regarding the compensation awarded to, earned by or paid to our non-employee directors who served on our board of directors during 2017.

| Name |

Fees Earned or Paid in Cash($) |

Option Awards ($)(1) |

All Other Compensation($) |

Total($) | ||||||||||||

| James K. Sims |

$ | 67,500 | $ | 40,956 | | $ | 108,456 | |||||||||

| Thomas A. Munro |

45,625 | 27,304 | | 72,929 | ||||||||||||

| Arthur M. Toscanini |

45,000 | 27,304 | | 72,304 | ||||||||||||

| Frances Kordyback |

35,625 | 27,304 | | 62,929 | ||||||||||||

| Francis X. Egan (2) |

33,750 | 27,304 | | 61,054 | ||||||||||||

| Joan Gillman |

42,500 | 13,652 | | 56,152 | ||||||||||||

| (1) | Amounts reflect the full grant-date fair value of stock options granted during 2017 computed in accordance with Accounting Standards Codification, or ASC, Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all option awards made to our directors in Note 12 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017 and filed with the SEC on March 15, 2018. |

| (2) | Mr. Egan resigned from the board of directors on January 31, 2018. |

On May 2, 2018, our board of directors appointed James K. Sims as our interim Chief Executive Officer.

On May 8, 2018, our board of directors, upon the recommendation of the compensation committee, approved the compensation arrangements for Mr. Sims in his role as interim Chief Executive Officer. In consideration of his service as interim Chief Executive Officer, Mr. Sims will receive a monthly retainer of $33,333.33, which equates to an annual retainer of $400,000. On May 8, 2018, Mr. Sims was also granted stock options to purchase 175,000 shares of our common stock, which will vest in equal quarterly installments over the two years following his commencement of service as interim Chief Executive Officer, subject to his continued service in that role or as a member of our board of directors on each vesting date. The stock options will also vest in full upon a change in control. Mr. Sims may also be awarded a discretionary bonus by our board of directors in connection with his service as interim Chief Executive Officer.

During his service as interim Chief Executive Officer, Mr. Sims will not be entitled to any additional fees or other compensation for serving as Chairman of the Board or as a member of our board of directors, including any fees or equity grants in accordance with our non-employee director compensation policy, although the equity awards previously granted to him in connection with his service as a member of our board of directors will continue to vest based on his service as interim Chief Executive Officer. Following his service as interim Chief Executive Officer, Mr. Sims will again be eligible to receive fees and equity grants in accordance with our non-employee director compensation policy.

The compensation payable to Mr. Sims and described above is solely for his services as interim Chief Executive Officer and not for his service as a non-employee member of our board of directors. Mr. Sims was not present for the deliberations or decision by our board of directors when it approved the foregoing compensation arrangements.

14

Table of Contents

The table below shows the aggregate numbers of option awards outstanding held as of December 31, 2017 by each non-employee director who was serving as of December 31, 2017.

| Name |

Options Outstanding at Year End |

|||

| James K. Sims |

73,380 | |||

| Thomas A. Munro |

42,980 | |||

| Arthur M. Toscanini |

55,180 | |||

| Frances Kordyback |

5,000 | |||

| Francis X. Egan |

22,681 | |||

| Joan Gillman |

12,500 | |||

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting at the annual meeting, directors shall be elected by a plurality of votes cast, meaning that the two nominees receiving the highest number of shares voted For their election will be elected to our board of directors. Votes withheld from any nominee, abstention and broker non-votes will be counted only for purposes of determining a quorum and are not considered votes cast for the foregoing purpose. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF JOAN GILLMAN AND ARTHUR M. TOSCANINI. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE ON THEIR PROXY CARDS.

15

Table of Contents

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has selected KPMG LLP as the companys independent registered public accounting firm for the year ending December 31, 2018 and has further directed that management submit the selection of independent registered public accounting firm for ratification by the stockholders at the annual meeting. KPMG LLP has audited the companys financial statements since 2012. Representatives of KPMG LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of KPMG LLP as the companys independent registered public accounting firm is not required by Delaware law, the companys amended and restated certificate of incorporation, or the companys amended and restated bylaws. However, the audit committee is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain that firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of different independent registered accounting firm at any time during the year if the audit committee determines that such a change would be in the best interests of the company and its stockholders.

Independent Registered Public Accounting Firms Fees

The following table represents aggregate fees billed to us for services related to the fiscal years ended December 31, 2017 and 2016, by KPMG LLP, our independent registered public accounting firm.

| Year Ended December 31, | ||||||||

| 2017 | 2016 | |||||||

| Audit Fees(1) |

$ | 475,000 | $ | 952,776 | ||||

| Audit Related Fees(2) |

265,000 | | ||||||

| Tax Fees(3) |

219,455 | | ||||||

| All Other Fees(4) |

124,117 | | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,083,572 | $ | 952,776 | ||||

|

|

|

|

|

|||||

| (1) | Audit Fees consist of fees billed for professional services performed by KPMG LLP for the audit of our annual financial statements, the review of our registration statements on Form S-1, the quarterly review of our financial statements, and related services that are normally provided in connection with statutory and regulatory filings or engagements. |

| (2) | Audit Related Fees consist of fees billed by KPMG LLP for audits of acquisitions. There were no such fees incurred in 2016. |

| (3) | Tax Fees consist of fees related to services rendered for the preparation of tax filings and completion of an R&D tax credit study. There were no such fees incurred during 2016. |

| (4) | All Other Fees consist of fees billed for professional services performed by KPMG LLP for acquisition due diligence services and an accounting research subscription. |

The audit committee has considered whether the provision of non-audit services is compatible with maintaining the independence of KPMG LLP, and has concluded that the provision of such services is compatible with maintaining the independence of our auditors.

Pre-Approval Policies and Procedures

Our audit committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the audit committee, and all such services

16

Table of Contents

were pre-approved in accordance with this policy during the fiscal years ended December 31, 2017 and 2016. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

Vote Required; Recommendation of the Board of Directors

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively on the proposal will be required to ratify the selection of KPMG LLP, meaning the number of shares voted For the proposal must exceed the number of shares voted Against the proposal. Abstentions will not be counted toward the tabulation of votes cast on this proposal and will have no effect on the proposal. The approval of Proposal 2 is a routine proposal on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE TO RATIFY THE SELECTION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE ON THEIR PROXY CARDS.

17

Table of Contents

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information relating to the beneficial ownership of our common stock as of April 24, 2018, by:

| | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of common stock; |

| | each of our directors; |

| | each of our named executive officers; and |

| | all directors and executive officers as a group. |

The number of shares beneficially owned by each stockholder, executive officer or director is determined in accordance with SEC rules. Under such rules, beneficial ownership includes any shares over which the person or entity has sole or shared voting power or investment power as well as any shares that the person has the right to acquire within 60 days of April 24, 2018 through the exercise of any stock options, warrants or other rights. Except as otherwise indicated, and subject to applicable community property laws, to our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock held by that person. For purposes of calculating each persons or groups percentage ownership, stock options, warrants and other rights exercisable within 60 days after April 24, 2018 are included for that person but not for any other person.

The percentage of shares beneficially owned is based on 9,442,794 shares of our common stock outstanding as of April 24, 2018. Unless otherwise noted below, the address of each person listed on the table is c/o Airgain, Inc., 3611 Valley Centre Drive, Suite 150, San Diego, CA 92130.

| Name and Address of Beneficial Owner |

Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| 5% and Greater Stockholders |

||||||||

| Entities affiliated with GEN3 Capital (1) |

1,054,748 | 11.2 | % | |||||

| Named Executive Officers and Directors |

||||||||

| Charles Myers (2) |

332,302 | 3.5 | % | |||||

| Leo Johnson (3) |

81,274 | * | ||||||

| Jacob Suen (4) |

76,320 | * | ||||||

| James K. Sims (1)(5) |

1,352,722 | 14.2 | % | |||||

| Joan Gillman (6) |

5,800 | * | ||||||

| Frances Kordyback (7) |

5,000 | * | ||||||

| Thomas A. Munro (8) |

44,980 | * | ||||||

| Arthur M. Toscanini (1)(9) |

138,050 | 1.5 | % | |||||

| All current directors and executive officers as a group (9 persons) (10) |

2,013,880 | 20.4 | % | |||||

| * | Indicates beneficial ownership of less than 1% of the total outstanding common stock. |

| (1) | Includes (a) 1,043,464 shares of common stock held by GEN3 Capital I, LP, or GEN3 Capital, and (b) 11,284 shares of common stock held by Gen 3 Partners, Inc., or Gen 3 Partners. The general partner of GEN3 Capital is GEN3 Capital Partners, LLC, or GEN3 LLC, and James K. Sims is the Managing Member of GEN3 LLC. As a result, each of GEN3 LLC and Mr. Sims may be deemed to share beneficial ownership of the shares held by GEN3 Capital. Mr. Sims and Arthur M. Toscanini may be deemed to share beneficial ownership of the shares held by Gen 3 Partners in their capacity as directors of Gen 3 Partners. Each of such persons disclaims beneficial ownership of the shares held by Gen 3 Partners and GEN3 Capital, except to the extent of their |

18

Table of Contents

| respective pecuniary interest therein. Information regarding these shares is based in part on the Schedule 13G/A filed by GEN3 Capital Partners, LLC on February 12, 2018. |

| (2) | Includes 136,378 shares of common stock that Mr. Myers has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. Mr. Myers resigned as our President and CEO on May 2, 2018. Pursuant to the terms of his employment agreement, an additional 282,944 shares subject to unvested stock options vested upon his termination of employment are exercisable, which is not reflected in the table above. |

| (3) | Includes 70,374 shares of common stock that Mr. Johnson has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (4) | Includes 31,320 shares of common stock that Mr. Suen has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (5) | Includes 73,380 shares of common stock that Mr. Sims has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (6) | Includes 5,800 shares of common stock that Ms. Gillman has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (7) | Includes 5,000 shares of common stock that Ms. Kordyback has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (8) | Includes 42,980 shares of common stock that Mr. Munro has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (9) | Includes 55,179 shares of common stock that Mr. Toscanini has the right to acquire from us within 60 days of April 24, 2018 pursuant to the exercise of stock options. |

| (10) | Includes shares of common stock issuable upon the exercise of outstanding options, as set forth in the previous footnotes. |

19

Table of Contents

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Our Executive Officers

The following table sets forth information regarding our executive officers as of May 8, 2018:

| Name |

Age | Position(s) |

||||

| James K. Sims |

71 | Interim Chief Executive Officer and Chairman of the Board |

||||

| Anil Doradla |

49 | Chief Financial Officer and Secretary | ||||

| Jacob Suen |

44 | Senior Vice President, Worldwide Sales |

The biography of James K. Sims can be found under Proposal 1Election of Directors.

Anil Doradla has served as our Chief Financial Officer since February 2018. From June 2008 to February 2018, Mr. Doradla served as a Senior Equity Research Analyst at William Blair. From June 2007 to June 2008, Mr. Doradla served as Senior Vice President at Caris and Company. Prior to that, Mr. Doradla was a Research Associate at Deutsche Bank from April 2006 to June 2007. From November 1998 to April 2006, Mr. Doradla was a Principal Technical Member of Staff at AT&T Labs. From 1994 to November 1998, Mr. Doradla served as a Senior Engineer at LCC International. Mr. Doradla holds a Master of Science in Electrical Engineering from Virginia Tech and a Master of Business Administration from the McCombs School of Business at the University of Texas at Austin.

Jacob Suen has served as our Senior Vice President, Worldwide sales since May 2017. He has been with the company since its April 2006 as the Vice President of Asia Pacific Sales. Previously, Mr. Suen served as the Director of Business Development from 1998 to 2005 at Paradyne Corporation. Prior to Paradyne, Mr. Suen was a Development Engineer at GVN Technologies in 1998. From 1997 to 1998, Mr. Suen was a Software Development Engineer for Motorola Incorporation. Mr. Suen holds a Master of Science in Electrical Engineering with a concentration in Communication Systems and a minor in Engineering Management from the University of South Florida. Mr. Suen also has his Master of Business Administration with a focus on International Business and Entrepreneurship from the University of Colorado.

Overview

This section discusses the material components of the executive compensation program for our executive officers who are named in the Summary Compensation Table below. In 2017, our named executive officers and their positions were as follows:

| | Charles Myers, former President and Chief Executive Officer; |

| | Leo Johnson, former Chief Financial Officer and Secretary; and |

| | Jacob Suen, Senior Vice President, Worldwide Sales. |

Effective February 5, 2018, the board of directors appointed Anil Doradla as our Chief Financial Officer. Mr. Johnson, our previous Chief Financial Officer, continued to serve as our principal financial and accounting officer for our public filings with the SEC until March 15, 2018 and continues to serve as an employee in a non-executive role. Effective March 16, 2018, Mr. Doradla began serving as our principal financial and accounting officer, replacing Mr. Johnson in such capacities.

On May 2, 2018, Charles Myers, our President and Chief Executive Officer and a member of our board of directors resigned from all positions with us, effective immediately, to pursue other opportunities. Our board of directors accepted Mr. Myers resignation on May 2, 2018.

This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt in the future may differ materially from the currently planned programs summarized in this discussion.

20

Table of Contents

Summary Compensation Table

The following table presents information regarding compensation earned by or awards to our named executive officers during 2017 and 2016.

| Name and Principal Position |

Year | Salary($) | Bonus($)(1) |

Stock Awards($)(2) |

Option Awards($)(3) |

All Other Compensation($)(4) |

Total($) | |||||||||||||||||||||

| Charles Myers, |

2017 | 400,000 | 250,000 | | 627,600 | 20,000 | 1,297,600 | |||||||||||||||||||||

| Former President, Chief Executive Officer and Director |

2016 | 360,000 | 800,000 | | 22,935 | 20,000 | 1,202,935 | |||||||||||||||||||||

| Leo Johnson, |

2017 | 300,000 | 125,000 | | 156,900 | | 581,900 | |||||||||||||||||||||

| Former Chief Financial Officer and Secretary (5) |

2016 | 225,000 | 200,000 | 40,756 | 45,868 | | 511,624 | |||||||||||||||||||||

| Jacob Suen, |

2017 | 310,000 | 195,000 | | 156,900 | | 661,900 | |||||||||||||||||||||

| (1) | Represents annual bonuses earned by the named executive officers for performance during the applicable year. The Bonus column for 2016 for Mr. Myers includes a $500,000 cash bonus paid to him upon consummation of our initial public offering in August 2016, pursuant to the terms of his employment agreement. |

| (2) | Amounts reflect the full grant-date fair value of stock awards granted during the relevant fiscal year computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all stock awards made to our named executive officers in Note 12 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017 and filed with the SEC on March 15, 2018. |

| (3) | Amounts reflect the full grant-date fair value of stock options granted during the relevant fiscal year computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all option awards made to our named executive officers in Note 12 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on March 15, 2018. The performance objectives to which the vesting of the performance-based stock option awards granted during 2016 to the named executive officers were subject were deemed probable of achievement as of the date of grant and the full grant date fair value of such awards, assuming achievement of the applicable performance objectives at maximum levels, is reflected in the table above. |

| (4) | For both 2017 and 2016, amount represents $5,500 paid for an annual executive medical program for Mr. Myers, $5,000 paid for health club dues and a personal trainer for Mr. Myers, and $9,500 in annual reimbursements for Mr. Myers vehicle payments, and the costs of maintenance and operation of such vehicle. |