10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 15, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 001-37851

AIRGAIN, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

20-0281763 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

3611 Valley Centre Drive, Suite 150 San Diego, CA |

|

92130 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(760) 579-0200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

|

Name of each exchange on which registered: |

|

Common Stock, par value $0.0001 per share |

|

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

Non-accelerated filer |

☒ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of February 28, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $90.2 million, based on the closing price of the registrant’s common stock on The NASDAQ Capital Market of $12.60 per share. The registrant has elected to use February 28, 2017 as the calculation date, as on June 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter) the registrant was a privately-held concern.

As of February 28, 2017, the registrant had 9,372,232 shares of common stock ($0.0001 par value) outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the registrant’s definitive proxy statement for the 2017 annual meeting of stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after end of this fiscal year covered by this Form 10-K are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

FORM 10-K

For the Year Ended December 31, 2016

INDEX

|

PART I |

|

|

|

|

Item 1. |

|

4 |

|

|

Item 1A. |

|

21 |

|

|

Item 1B. |

|

38 |

|

|

Item 2. |

|

38 |

|

|

Item 3. |

|

38 |

|

|

Item 4. |

|

38 |

|

|

|

|

|

|

|

PART II |

|

|

|

|

Item 5. |

|

39 |

|

|

Item 6. |

|

42 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 |

|

Item 7A. |

|

57 |

|

|

Item 8. |

|

57 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

57 |

|

Item 9A. |

|

57 |

|

|

Item 9B. |

|

58 |

|

|

|

|

|

|

|

PART III |

|

|

|

|

Item 10. |

|

59 |

|

|

Item 11. |

|

59 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

59 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

59 |

|

Item 14. |

|

59 |

|

|

|

|

|

|

|

PART IV |

|

|

|

|

Item 15. |

|

60 |

|

FORWARD-LOOKING STATEMENTS AND MARKET DATA

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact contained in this annual report, including statements regarding our future operating results, financial position and cash flows, our business strategy and plans and our objectives for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This annual report on Form 10-K also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this annual report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives. These forward- looking statements speak only as of the date of this annual report and are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Airgain, the Airgain logo, and other trademarks or service marks of Airgain appearing in this annual report are the property of Airgain. This annual report also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this annual report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

3

Overview

Airgain is a leading provider of embedded antenna technologies used to enable high performance wireless networking across a broad range of home, enterprise, and industrial devices. Our innovative antenna systems open up exciting new possibilities in wireless services requiring high speed throughput, broad coverage footprint, and carrier grade quality of service. Our antennas are found in devices deployed in carrier, enterprise, and residential wireless networks and systems, including set top boxes, access points, routers, gateways, media adapters, and digital televisions. Through our pedigree in the design, integration, and testing of high performance embedded antenna technology, we have become a leading provider to the residential wireless local area networking, also known as WLAN or Wi-Fi, antenna market, supplying to leading carriers, Original Equipment Manufacturers, or OEMs, Original Design Manufacturers, or ODMs, and system designers who depend on us to achieve their wireless performance goals. We also develop embedded antenna technology for adjacent markets, including enterprise Wi-Fi systems for on premises and cloud-based services, small cellular applications using Long-Term Evolution, or LTE, Internet of Things, or IOT devices, Digital Enhanced Cordless Telecommunications, or DECT, and automotive connectivity applications.

We have a strong reputation within the ecosystem of OEM, ODM and system designers and have multiple reference designs with the leading Wi-Fi chipset vendors. OEMs, ODMs, telecommunications and broadband carriers, and retail-focused companies rely on these reference designs and our engineering skills to deliver superior performance throughout the home and enterprise. We offer early design, custom engineering support, and superior over-the-air, or OTA, testing capability, and our design teams partner with customers from the early stages of antenna prototyping, throughput testing, performance and device integration to facilitate optimal throughput performance and fastest possible time to market. We view our chipset partner, OEM, ODM and carrier relationships as strategic components to our success. We use third parties to manufacture our products while maintaining oversight for critical test and calibration functions. We have 69 issued patents in the United States and 23 companion patents outside the United States, and 93 patent applications on file.

We are helping to foster the transition in the industry to more advanced wireless standards. Both consumer and enterprise applications in the WLAN market are in a period of expansion driven by the global transition from the older 802.11n wireless standard to the new 802.11ac standard. 802.11ac is faster and requires a greater number of antennas per device, which imposes more advanced wireless system and antenna designs within an ever increasing device ID. Going forward, new wireless protocols, such as 802.11ax, will continue to push the throughput ceiling even further upward, increasing reliance on an optimal antenna system to enable performance as close to the theoretical maximum as possible. We have a broad range of embedded and external antenna solutions for WLAN routers and access points, and we are the industry expert in throughput optimized antenna solutions for Wi-Fi applications. We have a proven history of working with OEMs and ODMs to integrate throughput optimized antenna solutions resulting in the industry’s best Wi-Fi performance. Our enterprise WLAN solutions help to meet the industry challenge of requiring a consistent and improved throughput experience.

We have approximately 550 antenna products in our portfolio. We shipped approximately 159 million antenna products worldwide in 2016 enabling approximately 54 million devices. During that period, we supplied our products to carriers, OEMs and ODMs in the United States, Europe, Canada and Asia, including ARRIS Group, Inc., Belkin International, Inc., Comcast Corporation, DIRECTV U.S., LLC, EchoStar Corporation, Huawei Technologies Co., Ltd., Sagemcom SAS, Samsung, Technicolor SA and ZTE Corporation, among others. We have achieved significant growth in our business in a short period of time. From 2012 to 2016, our sales have grown from $18.2 million to $43.4 million, while our net income has increased from a net loss of $1.1 million in 2012 to net income of $3.7 million in 2016.

Industry Background

The most common form of wireless network access technology is Wi-Fi, short for Wireless Fidelity. Wi-Fi is a standard established by the Institute of Electrical and Electronics Engineers, or IEEE, known technically as 802.11. The Wi-Fi standard is “the most ubiquitous wireless connectivity technology for internet access,” according to ABI Research, a market intelligence firm. Over time, the 802.11 protocol has evolved to deliver higher rates of data throughput, requiring more sophisticated devices and data transmission equipment to achieve it. Initially,

4

802.11b at 2.4 GHz, or gigahertz, delivered data at 11 megabits per second, or mbps, followed by 802.11a at 5GHz and 802.11g at 2.4 GHz, each providing data at 54 mbps. Subsequently, 802.11n was introduced at both 2.4 GHz and 5 GHz offering 300 mbps, and more recently 802.11ac entered the market offering bandwidth rated up to 1300 mbps on the 5 GHz band and 450 mbps on 2.4 GHz.

Wi-Fi enables devices to operate on a local area network, or LAN, or wide area network, or WAN, to connect to and access the internet and communicate with others without the use of cabling or wiring. It adds the convenience of mobility to the powerful utility provided by high-speed data networks and is a natural extension of broadband connectivity in the home and office. Wi-Fi was first utilized in applications such as computers and routers, and is now commonly embedded into everyday electronic devices, such as printers, digital cameras, gaming devices, smart phones, tablets and broadband access systems for video and data enablement. In addition, many new products are coming out with multiple wireless capabilities whereby Wi-Fi and other similar wireless protocols have become ‘must have’ features to extend a device’s basic utility. As an example, smart devices such as the Apple iPhone and Samsung Galaxy come equipped with Wi-Fi, Bluetooth and Near Field Communication, or NFC, functions, in addition to traditional cellular functions. Each of these represents a separate radio technology and each radio requires different antenna solutions to provide an optimal user experience.

Wireless technology has grown rapidly. When it was first introduced to the mass market in the United States in the mid-1980s, the primary application was analog cellular phone voice services. However, wireless has rapidly evolved as the shift to digital and Internet Protocol ramped up and the explosion of ubiquitous broadband connectivity was born. The rapid growth of internet applications, websites and media opportunities has given consumers unlimited uses for wireless devices including managing e-mail, online browsing and shopping, and running applications for business, personal productivity, and entertainment and media while on the go. Carriers and enterprises have also realized the economic benefits of wireless connectivity to enable efficient delivery of premium content and internet services in the home, enterprise and mobile. Over the past decade, wireless technologies such as cellular and Wi-Fi have emerged as mainstream networking platforms to connect people and data via devices. According to the Cisco Visual Networking Index, or the Cisco Report, there were approximately 7.9 billion mobile connected devices in 2015—1.1 for every person on Earth. By 2021, there are expected to be approximately 11.6 billion mobile-connected devices, representing nearly 1.5 mobile devices per person on Earth.

Opportunity in the home and enterprise

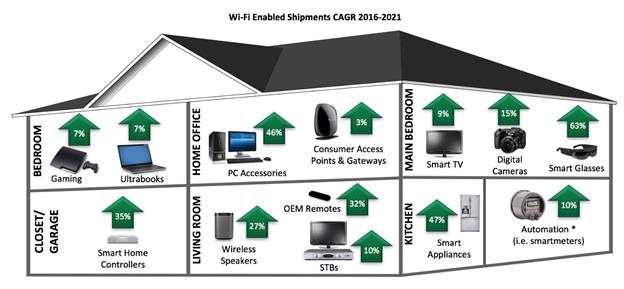

The Wi-Fi market is continuing to grow rapidly as the technology is adopted across a wide variety of markets, including consumer, mobile, automotive, and emerging markets such as machine to machine, or M2M. The increase of in-home wireless devices in security and remote monitoring, lighting, HVAC, and entertainment has helped drive the embedded antenna market. According to ABI Research, the number of Wi-Fi-enabled device shipments, excluding cellular and personal computers, is expected to exceed 1.3 billion devices annually by 2021, representing a 13% compound annual growth rate, or CAGR, in this market for the period from 2016 through 2021. The list of antenna applications within in-home devices is seemingly endless, including access points and wireless extenders, routers, residential gateways, set-top boxes, media adapters, smart televisions, smart remotes, printers, gaming consoles, wireless speakers, wireless cameras and home automation systems and nodes.

5

Wi-Fi Enabled Shipments CAGR 2016 to 2021

Sources: ABI Research Wi-Fi Market data, Q2 2016. * Represents 2014 to 2019 CAGR, Source Markets & Markets

We are seeing solid growth in the number of wirelessly-enabled device shipments in several of our key markets. According to ABI Research, the market for consumer access points and gateways worldwide is expected to increase from 173 million device shipments in 2015 to 199 million in 2019. In the same period, the number of set-top boxes shipped is expected to grow from 71 million to 91 million, and the number of smart TV’s shipped from 94 million to 146 million, a CAGR of 12%.

Mirroring this growth, according to ABI Research, global Wi-Fi hotspots, such as those found at enterprise locations like coffee shops, airports or in corporate offices, are forecasted to continue to expand at a CAGR of 11.2% from 2015 to 2020. The number of Wi-Fi hot spots in use was 4.2 million in 2013, 5.69 million in 2014, and is expected to top 13.3 million by 2020, according to estimates published by ABI Research in 2015. Wi-Fi hotspots are increasingly being deployed by mobile and fixed-line carriers, as well as third-party operators, as a means of offloading 3G/4G data users to Wi-Fi networks.

Trends driving demand for high-performance antenna solutions in wireless devices

The demand for smart phone, tablet, laptop and notebook connectivity in the home and enterprise is robust. Whereas families often shared a single computer and internet connection in the 1990’s, ubiquitous wireless connectivity throughout the home is available today via carrier gateways that enable Internet access and media distribution to multiple smart phones, fixed and mobile computing devices and smart TVs that share the same broadband data connections. Wireless access enables mobility and the potential sale of additional services by telecom, cable, and satellite broadcast companies and does not require the time and cost for cabling. Additionally, the demand for over-the-top, or OTT, audio and video services from the Internet is strong as families enjoy free or paid content subscriptions to sites such as Netflix, Apple TV, Amazon Prime, Pandora, YouTube, and many others on a 24/7 basis. Our business opportunity has been driven by the rapidly expanding market for embedded antenna solutions for in-home wireless data and video connectivity products. Wi-Fi has emerged as the key wireless technology for delivering media services in the connected home of smart devices. According to the Cisco Report, globally, in 2015, a smart device generated 14 times more traffic than a non- smart device, and by 2020 a smart device is estimated to generate nearly 23 times more traffic. Furthermore, the Cisco Report also anticipates that smart device traffic will grow at a CAGR of 53% from 2015 to 2020.

Wireless networking has also become mission-critical for businesses, schools, and governments to keep constituents connected. As more applications become cloud-enabled (meaning stored or run from servers in a data

6

center), access to these services becomes even more ubiquitous. Municipalities have also begun to offer free Wi-Fi services to citizens in public access locations. Some of this public access Wi-Fi is also served by the larger telecom and cable carriers. As Wi-Fi standards have gone from 802.11b/g to 802.11n, and more recently 802.11ac, the ability to access standard and high definition video over Wi-Fi becomes meaningful and drives demand. Carriers have been challenged to meet the requirements of the new high-bandwidth video and data applications. With current high-performance Wi-Fi, carriers can eliminate video cables, offering customers the ability to move their televisions to any point in the house and vastly reduce installation time and costs, as well as offer over the top, or OTT, services via broadband gateways that are accessible by any wireless device.

The increasing number of wireless devices that are accessing mobile networks worldwide is one of the primary contributors to global mobile traffic growth. Each year several new devices in different form factors and increased capabilities and intelligence are introduced into the market. With ever increasing smartphone penetration rates and a host of new devices such as M2M devices, tablets, netbooks, mobile internet devices, or MIDs, the growth for mobile broadband is at an all-time high and, according to the Cisco Report, is set to continue. The Cisco Report notes that global data traffic grew 74% in 2015, reaching 3.7 exabytes per month, up from 2.1 exabytes per month at the end of 2014. According to the Cisco Report, mobile offload exceeded cellular traffic for the first time in 2015. Overall mobile data traffic is expected to grow to 30.6 exabytes per month by 2020, an eightfold increase over 2015. Mobile data traffic is expected to grow at a CAGR of 53% from 2015 to 2020. According to the Cisco Report, 51% of total mobile data traffic was offloaded onto the fixed network through Wi-Fi or femtocell small cells in 2015. Globally, the total number of public Wi-Fi hotspots (including in- home Wi-Fi hotspots) is forecasted to grow sevenfold from 2015 to 2020, from 64.2 million in 2015 to 432.5 million by 2020. Total in-home Wi-Fi hotspots are forecasted to grow from 56.6 million in 2015 to 423.2 million by 2020. These trends are positive indicators for growth in our Wi-Fi and femtocell small cell markets.

Both consumer and enterprise applications in the WLAN market are in a period of expansion. Growth is due to WLAN expansion in emerging markets as well as a global transition from the older 802.11n wireless standard to the new 802.11ac standard. The 802.11ac standard provides much higher throughput rates and introduces multi-carrier technology requiring more antennas per device. 802.11ac devices can support up to eight Wi-Fi antennas, doubling the current average of four antennas per device under 802.11n standards. Wireless enabled in home devices are becoming increasingly complex as they evolve with industry technology trends, such as, 802.11ac higher order Multiple Input, Multiple Output, or MIMO, and Multi-User MIMO, or MU-MIMO, Wi-Fi architectures, while adding support for additional wireless connectivity systems, such as ZigBee Pro, ZigBee RF4CE, Z-Wave, and Bluetooth, to keep pace with the increasingly complex ecosystem of devices that seek connectivity within the home. Going forward, support for new and additional wireless protocols is likely to drive the antenna count up to 10 to 12 antennas per device.

Technology Challenges to Delivering on the Potential of Wireless

Our antenna solutions enable carriers and device OEMs and ODMs to meet their wireless connectivity performance requirements and to rapidly expand their footprint of products supporting Wi-Fi as well as the evolving network of connected home and the Internet of Things, or IoT, wireless connectivity applications. We develop our own antennas for a broad range of applications and technologies, including: 802.11 a/b/g/n/ac, LTE, DECT, LPD (433MHz RF remote), Bluetooth, ZigBee and Z-Wave. In addition, we have expertise in the testing and benchmarking of wireless systems and devices. To satisfy the rapidly evolving technology needs of the industry, we have remained on the leading edge of next generation development by providing solutions for MIMO, MU-MIMO, short range wireless technologies, beam forming, and active antenna technology.

As the number of wireless standards and antennas per device increases, the technical challenges for the antenna system increase, such as co-existence and isolation. With our unique and innovative integration technology, we have developed ways to integrate additional antennas for optimal antenna performance while minimizing the effects on isolation. Particularly with MIMO 4x4 and MIMO 8x8 technology, we are able to achieve the highest output and performance of Wi-Fi 802.11 ac/n, reliability, range, and coverage, with our role in optimal beam forming.

Given increasing capacity demands on wireless networks, the wireless industry continually searches for new means of utilizing more efficient radio resources. Active antenna systems utilize the full potential of radio sources

7

by integrating onboard amplifiers for reductions in cable attenuation. We are able to integrate antennas in arrays designed for individual element activation based on which elements deliver the signals to the clients most effectively. By manufacturing antennas that possess the capabilities to support new wireless technologies, we are able to meet current market demands for versatile antenna designs.

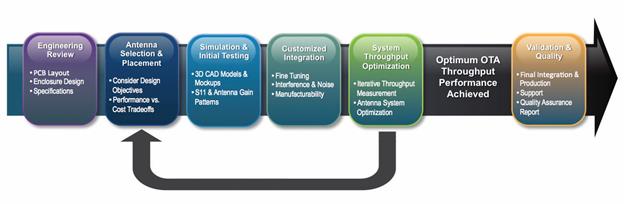

Our Antenna Design, Engineering and Integration Process

We are an antenna solution provider optimizing antenna systems for maximum system device OTA throughput performance as an integral step in the antenna system design process, enabling the best possible throughputs for devices in their native application. Common antenna industry practice is to design antennas exclusively within a passive environment, using simulation tools based on the assumption of free space. The modern in-home environment is a highly complex multipath environment that is not accurately represented by antenna simulation tool modeling. We design all our antenna systems for in-home applications using a combination of device and environment modeling, with active antenna OTA throughput performance feedback, providing our customers high device throughputs in their intended in-home or in-office environment.

The core focus of our proprietary antenna integration process remains performance optimization across factors that affect end users. Throughput, reliability, and cost represent three key metrics for optimization. We have been designing and evaluating wireless antenna solutions for 802.11-based WLAN devices since our inception in 2004. We have gained industry-leading expertise in the testing and evaluation of wireless systems to determine relative performance differences between devices, and have developed a proprietary set of performance metrics, measurement methodologies, and test conditions to enable measuring and predicting the relative performance of 802.11-based WLAN devices and networks at the component and application level. These simulations form the foundation of the integration process that optimizes overall device performance, as well as antenna characteristics.

There are many and varied challenges to integrating the optimal antenna system for maximized wireless performance for a device. Every aspect of the device design impacts the performance of the antenna system and ultimately the device itself. We work side by side with our customers as trusted advisors during the design process providing system level design feedback and support from the inception of a project through to the successful validation of the final product, ensuring reduced design cycles and the best possible performance outcome. We are proficient at identifying wireless performance impacting factors down to the board-level design details, including on-board noise and radio interference sources, coupling via onboard components, to constraints in the industrial design itself, such as horizontal and vertical orientations, internal structure layout and materials, and space limitations for antenna placement. All of these factors can negatively influence the performance of an embedded antenna system and can lead to de-tuning, coupling, sub-optimal gain patterns, and loss of gain, efficiency reduction and ultimately poor system performance.

Our antenna designs and integration methods are mindful that Quality of Service, or QOS, is the backbone of any successful communication network within a home or enterprise. Demand for wireless streaming 4K and Ultra-high definition, or UHD, video is requiring more sophisticated antenna system designs to support a high quality end user experience free from errors in frame rendering, pixilation, and buffering delays and glitches. While the

8

performance of the underlying chipset and firmware lays down the foundation, the optimally integrated antenna system is a key system component and is usually the key enabler of throughput and coverage differentiation between competing devices.

Our engineers provide custom support in the areas of antenna system design and simulation, rapid prototyping, integration and testing. Our engineers work directly with customers (typically OEMs and/or ODMs) to evaluate performance-impacting factors when developing the optimal antenna solution for each device and application. Antenna-specific characteristics, such as gain, efficiency, and coupling, are considered during the design process in conjunction with board-level factors, such as on-board noise and radio interference, together with industrial design and housing constraints.

We engage with customers in the early stages of a program before prototype tooling is available, utilizing 3D CAD models and/or physical mockups of our customers’ devices to simulate and measure the interactions, providing valuable feedback for the device design enhancement. During prototyping, sample devices are tested to generate more precise measurements. These measurements are carried out in our anechoic radio frequency, or RF, chambers, including our Satimo SG 24 antenna measurement system located at our San Diego headquarters. The chamber environment provides a broad dynamic range for antenna measurements, enabling wireless performance testing for a wide range of protocols including LTE, IEEE 802.11 standards including ac, ah, af, GPS, ZigBee, Z-Wave and GPS. While other antenna design companies may select a final antenna based only on passive testing, our process includes the key additional step to measure and optimize the actual system-level throughput and coverage performance through our proprietary iterative design feedback process. This process considers firmware stability, system noise, and interference, as well as antenna performance, to provide an “Airgain Optimized” solution.

We partner with and supply the largest blue chip brands in the world, including OEMs, ODMs, chipset makers, and global operators. Through our close working relationships with the leading chipset makers for the WLAN, we have developed a significant level of expertise in the testing and evaluation of chipset reference designs and systems enabling the relative performance benchmarking between devices. To satisfy the rapidly evolving technology needs of the industry, we have remained on the leading edge of next generation development including solutions for MIMO, MUMIO, beam forming, and active antenna systems.

Our design and integration process is summarized as follows:

|

|

• |

Engineering Review. When a new product is initiated, our engineers review antenna-specific characteristics, such as gain (throughput), efficiency, and coupling, alongside board-level factors, such as on-board noise and radio interference, as well as identification and housing constraints. We plan to expand awareness of the Airgain brand and Airgain offerings throughout the OEM and carrier community through participation in industry technical working groups, forums and trade events. |

|

|

• |

Antenna Selection and Placement. Our engineers select several antennas that are best suited for the particular application based on a large stable of existing antenna designs from previous efforts, modifications to these prior designs as well as new, full custom designs for particular devices, coupled with the industrial design of the product, the engineer also selects candidate placements that are used in the initial simulation and placement phase. Our extensive experience in this step narrows the possible solutions to only the most promising candidates for detailed simulation and measurement. |

|

|

• |

Simulation and Initial Testing. Finite element simulations of the antennas in the enclosure are then used to understand the complex interaction of the antennas with the structures within the product. These interactions have a profound impact on the operation of the antenna system and understanding them is key to providing optimal solutions. When we engage in the early stages of a program before prototype tooling is available, 3D CAD models and/or physical mockups of the device are used to simulate and measure these interactions. When the project progresses to the prototype stage, actual prototype devices are tested to generate even more accurate measurements. These measurements are carried out in one of four RF chambers, including our Satimo SG 24 antenna measurement system at our San Diego headquarters, which provides a high dynamic range in antenna measurements that enables us to test wireless performance for a wide range of protocols including LTE, IEEE 802.11n, and IEEE 802.11ac Wi-Fi standards. While our competitors select a final antenna based on RF chambers testing, we proceed with a critical further step and measure actual system level performance of the device in an iterative process to optimize performance. This iteration considers firmware |

9

|

|

stability, system noise, and interference, as well as antenna performance, to provide an “Airgain Optimized” solution. |

|

|

• |

Final Integration. Prior to OTA throughput testing, a final review of the design is conducted to review for cable routing for manufacturability and noise reduction. Mounting methods from our designed clip structures to tape mounting are reviewed for ruggedness and ease of assembly in volume production. Finally, any fine tuning of the cable routing, antenna parameters or other features is conducted before releasing the design for final testing and optimization with OTA throughput testing in actual real use case testing. |

|

|

• |

Validation and Reporting. Upon completion of the design, a summary report is provided detailing the antenna selection, overall performance results and key observations, integration recommendations and detailed test results for each wireless system characterized. As the design moves to production, our product integration engineers serve as the technical interface between the antenna design team and the customer’s production team to validate and ensure product quality and reliability during high volume manufacturing. |

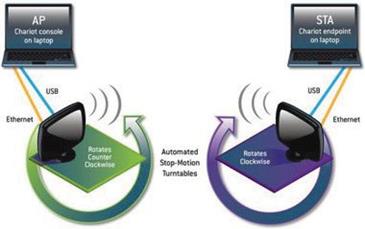

Our over-the-air throughput testing

We have been designing and evaluating wireless antenna solutions for 802.11-based wireless LAN devices since our inception in 2004. We have developed a set of proprietary performance metrics, measurement methodologies, and automated test conditions to enable accurate and repeatable characterization of the relative OTA performance of 802.11-based WLAN devices from routers, gateways, and set-top boxes, to TV sets. Our benchmark testing provides an accurate assessment of the performance characteristics for devices to enable manufacturers to make informed decisions in selecting the best antenna solution for their needs.

We have developed a proprietary hardware and software solution using stop-motion turntables to measure effective throughput of competing antenna solutions. This technology, illustrated below, enables the capture of thousands of data points at each location and ensures accurate and repeatable results. This throughput-focused testing provides repeatable comparisons of metrics that our customers value above antenna specific measurements alone. Our OTA test process utilizes industry standard measurement tools and our proprietary implementation of the IEEE 802.11.2 Draft Recommended Practice for the Evaluation of 802.11 based Wireless Performance. Our proprietary OTA testing process has been established as an industry leader in wireless throughput testing.

We have developed a well-defined set of antenna engineering and integration steps to find the optimum antenna solution within any design constraints. Each customer design is put through a series of distinct Access Point to Client device link tests to measure the average uplink and downlink throughput at each link. Multiple independent, unique AP/Client locations are selected to provide relative throughput test results in high, medium, and low throughput environments. Continual feedback to our customers across the spectrum of system performance (noise, firmware, OTA performance) leads to an optimized design.

Our regional OTA testing facilities are configured to replicate the real-world performance in typical homes and offices, while providing isolation from external RF and wireless interference. This low noise environment is key

10

when comparing and identifying the effect of various antenna and system designs on wireless throughput performance. We have multiple dedicated test sites located in the vicinity of our development locations in San Diego, California, Cambridgeshire, United Kingdom, and Suzhou and Shenzhen, China. These test environments allow extended length testing of our antenna solutions at up to 200 feet separation of access point and station. The combination of proprietary testing methods, dedicated test facilities, thousands of hours of test data, experience with hundreds of devices and antenna simulation techniques, have enabled us to provide higher- performance antenna solutions across multiple product platforms as compared to competing antenna systems.

Typically our proprietary integration process goal is to achieve a significant performance improvement over competing antenna solutions – providing a performance advantage that enables more robust wireless connectivity solutions for our customers. In a recent example, where we upgraded a commercially available 55” flat screen smart television with Airgain technology, we increased the probability of the television supporting a wireless (Wi-Fi) 4K UHD content video stream connection (4K UHD requires uplink capacity in the range of 25-50 mbps) by up to 100% using our in-house testing process.

Benefits of our Technology

We continuously ensure that we remain at the forefront of wireless technologies by manufacturing the highest quality and most innovative products, as well as developing new integration processes to produce optimal antenna performance.

Benefits to our customers

We have developed strong relationships with leading WLAN chipset vendors, OEMs, and key service providers in the home networking space, keeping us at the forefront of new developments in wireless technologies and industry requirements. We share our expertise with customers in several areas including design, engineering, and testing. Because of our focused business, we can offer insight into problems and develop solutions based on knowledge gained from the release of approximately 550 unique antenna product SKUs to customers. By harnessing our specialized experience and expertise, we offer solutions that can improve our customers’ product performance, reduce their staff costs and allow our customers to focus on non-antenna related factors in the face of short design, engineering and production windows. Rather than rely upon a captive engineering group that only works on in-house opportunities, we act as an outsourced antenna design, engineering, and test group for our customers.

We have also entered into joint development agreements with WLAN chipset vendors to collaborate on next-generation WLAN reference designs. Under these agreements, we have agreed to jointly pursue the development of reference design platforms optimized for use with integrated embedded antenna systems. These WLAN reference designs are intended to provide ODMs with high-performance, embedded antenna solutions from us that provide consistent, measureable results and provide a path to reduced product development costs and cycle times.

Benefits to Wireless Users

By focusing on performance, we strive to improve product satisfaction with customers. Often, competing makers of wireless devices use chips that are made by the same semiconductor manufacturer. Antenna reliability depends on numerous factors including material, mount position, physical connection and resistance to oxidation. However, the selection and placement of an antenna, or antennas, can change the performance characteristics measurably. Each sale of an antenna solution is customized according to the needs and requirements of the customer. Tradeoffs exist on placement, power, price, and other variables. By focusing on performance, we look to engineer and deliver the optimal solution given the customer’s product constraints. This commitment to performance has established us as one of the recognized leaders in the design, testing, and performance of wireless systems, and led to what we believe is one of the broadest blue chip customer lists in the industry.

Our Products

Our antennas are found in end-user devices that are deployed in carrier, enterprise, and residential wireless networks, including WLAN, access points, routers, residential gateways, set-top boxes, media adapters, and digital

11

televisions. Our products have been adopted by some of the world’s leading telecom manufacturers and networking companies and are now being used by millions of carrier subscribers in the United States, Canada, Europe, and Asia. Designed for use in wireless access points, routers, gateways, set-top boxes, and media systems, we offer six product lines designed to maximize the performance of wireless devices while providing cost and design flexibility:

MaxBeam High Gain Embedded Antennas. MaxBeamTM High Gain Antennas utilize patented beamforming technology to deliver up to double signal strength and receive more sensitivity than conventional antenna solutions. The superior performance is derived by combining the benefits of high gain directional antenna elements with high isolation between each beam. Each antenna utilizes mixed material, integrated multi-element assemblies to provide optimal performance and turnkey integration. The MaxBeam antenna family offers maximum coverage designed for WLAN and Cellular/LTE frequency bands. Single-, dual-, tri-band and concurrent radio, as well as switched Smart Antenna options are available.

Profile Embedded Antennas. Profile Embedded Antennas feature highly efficient printed circuit board, or PCB, based solutions offering low profile designs optimized for confined industrial designs. Ideal for embedded applications requiring integration flexibility, the Profile family includes case, through- hole, and SMT mount designs and is available in single-, dual-, and tri-band applications.

Profile Contour Embedded Antennas. Profile Contour Embedded line utilizes Flexible Printed Circuit Board, or FPC, providing performance with device integration flexibility. Flexible and very low profile, these antennas can conform to many two-dimensional shapes making them ideal for integration within curved enclosures and wearable devices. Profile Contour antennas are supplied pre-fitted with adhesive tape for ease of integration.

Ultra Embedded Antennas. The Ultra line of embedded antennas has been designed for lower cost, embedded applications. The stamped metal design allows for rapid customization and tuning to each device, making them ideal for embedded applications requiring integration flexibility. The Ultra line is ideal for very high volume applications, and they utilize superior materials and plating to ensure optimal performance and extended life. The Ultra line is available in cabled and PCB mount designs, for single- or dual-band/feed operation.

OmniMax High Performance External Antennas. Our external dipole antennas are designed for indoor and outdoor WLAN applications. With an extensive variety of single- and dual-band designs available, this family of dipoles offers superior performance and flexible mounting options for various deployment scenarios including Prosumer level devices. They have a very high efficiency and omni- directional gain characteristics across 2.4 and 5 GHz bands to provide optimal coverage for maximum throughput and range.

MaxBeam Carrier Class Antennas. We have developed a series of multi-band LTE and WLAN antennas for small cell systems including Femtocells, Picocells, Wi-Fi hotspots, Wi-Fi backhaul, and community Wi-Fi systems, providing increased range and coverage. These embedded antennas have been designed for indoor or outdoor applications demanding Carrier-grade service levels, where complex issues such as coexistence and isolation between wireless standards in close proximity need to be tightly controlled. Maxbeam Carrier Class antennas achieve the best performance in the smallest possible form factor to minimize the urban landscape footprint.

SmartMax Embedded Antennas. SmartMaxTM chipset agnostic antennas utilize dynamic spatial and polarity selection, providing optimal throughput performance and coverage for 802.11ac Wi-Fi systems. Designed for set-top-box, gateway, and smart HDTV deployments, SmartMax improves spatial correlation among received signals, producing a significant improvement in the performance of MIMO systems. SmartMax provides up to a 25% downlink throughput improvement for Smart TV applications. SmartMax antennas require no dedicated connectivity to Wi-Fi chipset base-band circuits, minimizing the cost and complexity typically associated with Smart Antenna System integration. We launched the SmartMax line in January 2017.

These antenna product lines are incorporated into an array of devices varying in purpose, as seen in the chart below. In addition, we have a strong patent portfolio and technology in the area of switched multi-beam antennas

12

and dynamically optimized smart antenna systems that would allow us to move into the enterprise class market for Wi-Fi hotspots and small cells, or low-powered radio access points.

Design Partnerships

Our collaborative relationships with 802.11 chipset vendors offer opportunities for market access and improved sales of both chipsets and antennas. Early access to chipset vendors’ offerings, including industrial design tradeoffs in enclosure, board layout and design, all offer chipset vendors the advantage of optimized performance in their reference designs. When our antennas are consequently listed in the reference bill of materials for the major chipset vendors’ products, these antennas become the default performance recommendation for all products utilizing that chipset. Ongoing contact with the OEM’s and ODM’s, along with default use of the reference bill of materials components specified by chipset vendors, generates a dependable flow of sales opportunities for us.

Smart Antenna Technology

While we believe our embedded antenna solutions provide significant performance improvement over competing antenna products and meet the demand of today’s market, the need for even better wireless coverage in home networks continues to grow. Wireless video offerings from service providers are becoming more commonplace, and next generation technologies require ever increasing data speeds, bandwidth and coverage to meet rising consumer expectations.

There are basically two ways to improve the data transfer speed in wireless networks: improve the efficiency of encoding the data on the wireless carrier signal, or reduce the need to re-transmit data to make up for poor reception. Improving the encoding efficiency requires a change in the protocol standard, which occurred when the industry transitioned from 802.11b/g/a standard to the 802.11n standard, and continues to occur today, such as with the recent transition to the new 802.11ac standard. However, there remains a fundamental relationship between the quality of the wireless signal, and performance, and the amount of information any signal can carry.

To improve signal quality, we have developed our smart antenna technology, which serves as a very effective way to direct radio wave energy and point this focused energy in a chosen direction. This focused energy is then harnessed to improve data communication in wireless networks through a set of proprietary algorithms implemented in software and firmware that can greatly enhance the range and data throughput performance versus conventional solutions. All of the algorithms operate within the standardized protocols for 802.11 networks and are fully compatible with existing products on the market.

13

The improved antenna performance of our smart antenna system is based on combining the benefits of multiple antennas with self-adaptive automatic antenna switching. Our patented antenna tuning process is very rapid and is applied automatically both to receiving and transmitting functions. This same control method can be used with many different physical antenna configurations, and allows our antennas to achieve greater performance than conventional solutions. Our patented Smart Antenna technology is very effective at improving the signal quality of WLAN connections. These smart antennas are optimized to receive signals from single or multiple antenna element systems, dynamically and in real time selecting the optimal configuration maximizing the performance of any given data transmission.

Our Smart Antenna switching algorithms can be applied to almost any type of antenna structure. Our Smart Antenna algorithms power intelligent switching between elements in multi-element antenna systems, however the technology can equally be applied to single element smart antenna systems whereby switching can be used to dynamically re-configure antenna patterns to maximize throughput and coverage for a given environment.

Our switched smart antenna solution focuses on delivering improvements in several key areas:

|

|

• |

Quality of service. Delivering consistent bandwidth for real-time demands of video distribution or Voice over Internet Protocol, or VoIP, streaming content to tablets and other mobile devices. |

|

|

• |

Extended range. The ability to reliably connect devices at the maximum extent of the device. |

|

|

• |

Interference avoidance. The proliferation of Wi-Fi has led to considerable levels of RF interference. Smart “agile” antenna systems dynamically avoid interference sources and allow maximum throughput. |

|

|

• |

Per client optimization. Our Smart Antenna solutions are capable of analyzing individual client throughput, optimizing the antenna directionality and enhancing the throughput to individual clients. |

We have a history of over 10 years of innovation in beamforming and smart antenna technology for the wireless networking market. We designed and patented some of the first commercially shipping smart antenna solutions for WLAN, and we continue to ship smart antenna systems today. We own a comprehensive portfolio of patents covering smart and embedded antennas, including smart antenna selection and switching. Our intellectual property, or IP, portfolio centers on antenna design and performance, and includes 92 issued patents and 93 pending patent applications covering smart antenna hardware and software solutions for Wi-Fi, LTE and MIMO applications.

We see growing opportunities for our Smart Antenna technology in the enterprise access point market and have developed antenna systems for both 802.11n and 802.11ac implementations. We provide hardware solutions to OEMs and consult with customer software teams to realize these benefits with software implementations ranging from a light application that delivers most of these benefits to a fully integrated software solution that maximizes the benefits of smart switching.

Our Growth Strategy

We continue to expand our product solutions and technology offerings and enter into new market segments within the home networking market. In our carrier gateway and set-top box market, the transition to the 802.11ac standard continues to be a key driver to penetrating the market with our new antenna solutions. The shift toward Gigabit Wi-Fi 802.11ac is in the early stages and is creating increased demand for our solutions as the number of antennas per device increases substantially.

We plan to continue to drive into product segments outside the home networking area, including growing opportunities in the enterprise AP, home security, smart TV, medical, and telematics markets. We plan to penetrate an increasing scope of target adjacent in-home wireless device applications such as home security, smart appliances, waterproof and solar outdoor wireless systems, as well as expanding our footprint in new markets for related antenna technologies such as enterprise, LTE, Bluetooth, ZigBee, and machine to machine, or M2M, applications. We have recent project wins and new customers in adjacent markets such as security cameras, smart remote controls, smart TVs, and sound bars and we anticipate continued growth of our share in these markets in the upcoming years.

14

The global smart TV market is expected to grow at a CAGR of over 49% through 2021, driven by thinner, larger, curvier, brighter, and ever higher definition displays packed with bandwidth-hungry applications. There is an industry trend for the set-top-box/cable and OTT device function to move into the TV overtime that is making high performance wireless connectivity increasingly relevant for smart TVs. Consumers expect error free wireless 4K and UHD streaming to their smart TV’s which demands optimal performance Wi-Fi. We are experiencing a tremendous uptick in demand for antenna systems for 4K and UHD display TVs. As a key supplier to these next generation TVs, we are constantly developing new antenna solutions and shipping millions of integrated antenna systems for this segment per year. The favored location of antennas for these devices has traditionally been the edge of the screen bezel, however these existing locations for antennas are disappearing as the width of the screen bezel narrows to enable a wider viewing area, therefore new antenna systems and locations are needed to obtain optimal performance. We have experience designing and integrating antenna systems for large smart TV’s with optimal front of screen Wi-Fi coverage while providing the highest possible throughput performance.

The connected home market has seen an explosion of automation services and broadband-connected devices, making the demand for increased bandwidth and reliable connectivity more critical than ever before. We have created solutions for the quickly evolving home security market, including security gateways, window and door sensors, wireless keypads, and surveillance cameras. Our engineering team provides custom antenna solutions to support a variety of device constraints, including flexible antenna technology for curved and smaller form factors. We provide IP alarms and security camera solutions for one of the world’s leading providers of video surveillance products.

We have developed a series of multi-band LTE and WLAN antennas for small cell systems including Femto cells, pico cells, Wi-Fi hotspots, and community Wi-Fi systems, providing increased range and coverage. Designed for indoor and outdoor implementations, our small cell antenna designs provide high-gain, high- performance solutions for multi-frequency and multi-mode network deployments. This includes several designs based on our patented smart antenna technology that delivers increased coverage and operational stability. Our customized small cell antenna systems address a new and growing market opportunity outside of the in- home area. This market is characterized with lower unit volumes, and higher antenna sell prices compared to the in-home antenna market.

We offer a comprehensive set of services for single- and multi-client Wi-Fi performance testing, characterization, and validation for wireless devices utilizing advanced MIMO configurations and technologies including WLAN, Bluetooth, ZigBee, Z-Wave, and more. Our service offering includes early stage system design, custom engineering support, and superior OTA testing services for service providers and OEMs. Our proprietary OTA testing process has established itself as an industry leader in wireless throughput enabling our service offering to create stickiness with customers as they depend on our testing services. We believe there is significant potential for growth of our service offering revenue, including through renewable service provider service contracts, and to further leverage this offering to customers and applications in adjacent markets.

Our mission is to be the world’s leading supplier of smart and embedded antennas to the expanding wireless device and systems marketplace. The key elements of our strategy are listed below.

|

|

• |

Expand our customer base within our core markets. We sold our products in 2016 to approximately 70 end-customers. Although the customers that pay for our products are often ODMs and distributors, it is primarily the OEMs, carriers and retail-focused end-customers that drive the selection of our solutions. |

|

|

• |

Increase our sales to existing customers. Within our customer base, we offer solutions that are valued for performance and reliability. In many cases we are providing antenna solutions for an isolated subset of our customer’s wireless product portfolios. We plan to initiate targeted marketing campaigns to expand our solutions footprint—effectively to mine our existing customer base more effectively to expand our revenue on a per customer basis. |

|

|

• |

Expand geographically. We service markets domestically and internationally. In the United States we have a strong position with the carriers that supply in home residential wireless equipment; however, there is significant scope for expansion in international regions. The substantial majority of our sales are to ODMs and distributors based in China. However, for the year ended December 31, 2016, approximately 43% of the end-customers of our products, based on sales, were in North America and approximately 57% were outside of North America. |

15

|

|

• |

Innovate into new products and markets. Trends such as the IoT are driving an explosion of demand for wireless connectivity in new applications in and out of the home, including connected vehicles. Our technology and solutions are well suited to the majority of these high growth potential new markets. As an example, by 2020, BI Intelligence estimates that 75% of cars shipped globally will be built with the necessary hardware to allow people to stream music, look up movie times, be alerted of traffic and weather conditions, and even power driving-assistance services such as self-parking. The connected-car market is projected to grow at a five-year CAGR of 45%—ten times as fast as the overall car market. We also see new opportunities in M2M communications, LTE, Near Field Communications, Identification and Tracking via Radio Frequency Identification, or RFID, Personal Area Networks such as ZigBee, Z-Wave or Bluetooth, and other wireless communications methods and applications. |

|

|

• |

Focus on system performance and products with long lifecycles. We have sticky customer relationships with over 43% of our revenues in 2016 driven by customer programs exceeding 2 years on the market. Our antenna solutions are typically integrated into customers’ products at the design stage. Once an equipment manufacturer designs our antennas into its product offering, it becomes difficult to design us out of a device because changing antenna suppliers involves significant cost, time, effort, and usually re-certification of products. This is especially valuable in the service provider market, where product generations generally ship for two to three years before displacement by next-generation devices. |

|

|

• |

Acquire complementary technologies, assets and companies. The market for antenna solutions is diverse and fragmented. Opportunities arise for acquisition of technologies, assets and companies that would complement our business. We continue to consider acquisitions that will enable us to improve our strategic position and to take advantage of economies of scale through consolidation. |

Customers

Our customers are global. The substantial majority of our sales are to ODMs and distributors based in China. However, for the year ended December 31, 2016, approximately 43% of the end-customers of our products, based on sales, were in North America and 57% were outside of North America. In addition, our top two customers, Syntech Asia Ltd. and Synnex Technology International (HK) Ltd., accounted for approximately 31% and 20% of our sales, respectively, for the year ended December 31, 2016. We generally work with Engineering, Product Management, Product Line Management, Product Marketing, Design, and similar groups to provide antenna solutions. While the sale of the product may be to an OEM or ODM, we also consider our customers to include chipset vendors and service providers. We market our design capabilities directly to chipset vendors and service providers to generate demand.

|

|

• |

OEM (Original Equipment Manufacturer). We sell our products to OEM customers worldwide. These customers make many products including Wi-Fi access points and repeaters, set-top boxes, video gateways, and other wireless equipment found in homes, schools, businesses, and networks. Typically, these customers work with us to help overcome a specific performance issue, or to improve product performance against internal or external benchmarks. OEMs are also often mandated by service providers to select us. |

|

|

• |

ODM (Original Design Manufacturer). We sell our products to ODM customers worldwide with the vast majority being headquartered in Asia. These customers make many of the same products as the OEM customers, but they make these for sale to an OEM or service provider customer. Generally, ODM customers do not own all of the rights to the design and engineering assets of the products they produce and deliver. Historically, ODMs have been thought to focus primarily on cost; however, our ODM customers also emphasize performance and design flexibility when working on antenna selection and placement. |

|

|

• |

Chipset Vendors. We sell small quantities of our products directly to chipset vendors for their reference designs. Through our close working relationships with the leading chipset makers for the WLAN we have developed a significant level of expertise in the testing and evaluation of chipset reference designs and systems. Chipset vendors and Semiconductor manufacturers work with us to promote better integration and improved performance, and to create optimal reference designs. These customers help influence purchasing decisions with OEM and ODMs as their reference designs and associated Bills of |

16

|

|

Materials (BoM’s) and suppliers are usually closely replicated in production designs. This can also improve time-to-market for OEM and ODM customers. |

|

|

• |

Service Providers. We do not sell antennas directly to telecommunications and broadband service providers, but these companies often specify overall product performance, and sometimes use our wireless test and validation services. By working with the service providers, we are often written into the carrier’s specifications, which are sent to the OEM or ODM. Our antenna products are then shipped directly from our contract manufacturers to the device manufacturer. In doing so, we can have an impact on an OEM’s or ODM’s ability to hit certain performance levels. We have worked with service providers, and in some cases, we have sold testing equipment that mirrors the testing equipment and environment we use internally. |

Sales and Marketing

Our sales and marketing organizations work together closely to improve market awareness, build a strong sales pipeline, and cultivate ongoing customer relationships to drive sales growth.

Sales

We sell our products to OEMs, ODMs, carriers and through manufactures for retail. Our global sales effort consists of direct and indirect sales teams, and indirect channel partners. Our direct sales team consists of inside sales personnel based in China and Taiwan and our outside field sales teams based in United States, Europe, Korea, China, and Taiwan. Our outside field sales teams consist of business, sales, account, technical marketing and program managers, and field application engineers, or FAEs. Our indirect channel partners consist of distributors, engineering design companies and outside sales representatives.

Our outside sales team is engaged in pre-sales, account management, and creating partnership opportunities with third parties such as service providers and semiconductor manufacturers. They are assigned quotas and have defined sales territories and/or accounts. The sales process includes meeting and qualifying potential programs and customers, and actively managing the planning stage of devices they plan to bring to market. Our FAEs assist these managers by providing technical support to existing customers. We intend to invest in our direct sales organization to drive greater market penetration.

Our indirect channel partners provide lead generation, pre-sales support, product fulfillment and, in certain circumstances, post-sales customer service and support. This channel partner network often co-sells with our inside sales and field sales teams. Our channel provides us with additional sales leverage by sourcing new prospects, providing technical support to existing customers, upselling for additional use cases and daily indexing capacities, and maintaining repeat business with existing customers. These channels provide added coverage to customers and prospects we cannot reach directly. The percentage of our sales from indirect channel partners was 23%, 19% and 39% for the years ended December 31, 2016, 2015 and 2014, respectively.

Marketing

Our marketing strategy is focused on building market awareness and acceptance of our products, and promoting our brand. We market our products directly to both prospective and existing customers. The marketing department is engaged in product management, product marketing, program management, corporate marketing, tradeshows and public speaking, development of our website and collateral material, and creating partnership opportunities with third parties, such as service providers and semiconductor manufacturers. Marketing emphasizes our competitive strengths, and provides input into the future direction of product development and customer profiles.

Our primary marketing initiatives include trade shows, industry events, industry reputation, and publications, including white papers and trade journals. We strategically choose the location and focus of each trade show based on each show’s prospectus, reputation, and audience attendees, allocating marketing funds to support shows annually in North America, Asia, and Europe. Those decisions aid with scheduling meetings with our target audience. These shows provide us with the opportunity to showcase our newest products and system designs, as well as set up meetings with current and potential OEM and ODM customers, carriers, and chipset partners. We provide

17

updates to new products and discuss specific applications and technology while making sure to relay our specific messaging to our audience.

Competition

The embedded antenna market is highly competitive and is characterized by rapid technological change and evolving standards. Our principal competitors fall into three categories:

|

|

• |

Direct competitors. Direct competitors include independent antenna companies, including Adant Technologies Inc., Antenova Ltd., Asian Creation Communications Factory, Ethertronics Inc., Fractus S.A., Baylin Technologies Inc., Galtronics Corporation Ltd., Honglin Technology Group Ltd., L-com, Inc., PCTEL, Inc., Pinyon Technologies Inc., Raylink Inc., Sunwave Communications Co., Ltd., Taoglas Limited, Wanshih Electronic Co. Ltd., and WHA YU Industrial Co., Ltd., among others. In addition, the barriers to entry for the antenna industry are low, and we expect new competitors to emerge in the future. |

|

|

• |

In-house Antenna Design and Engineering Teams. Several of our existing customers, including ODMs which design and build complete wireless devices, also have internal resources to design, engineer, and produce antenna solutions. In such cases, we compete against the captive resource of that ODM. Several ODMs, including Gemtek Technology Co. Ltd., Wistron Corporation, Foxconn Electronics Inc., and Arcadyan Technology Corporation, design, manufacture, and sell antennas, in direct competition with us. |

|

|

• |

Third-Party Custom Design and Engineering Companies. Some of our existing customers and prospects use outsourced engineering services to provide antenna solutions. In these cases, there may be short-term or long-term contractors who work to design, engineer, test, and manage production of an antenna solution. |

The principal competitive factors in our market include:

|

|

• |

Price and total cost of ownership as a result of reliability and performance issues; |

|

|

• |

Brand awareness and reputation; |

|

|

• |

Antenna performance, such as reliability, range, throughput; |

|

|

• |

Ability to integrate with other technology infrastructures; |

|

|

• |

Offerings across breadth of in-home wireless products; |

|

|

• |

Antenna design and testing capabilities; |

|

|

• |

Relationships with semiconductor/chipset vendors; and |

|

|

• |

Intellectual property portfolio. |

We compete primarily based on antenna performance, our intellectual product portfolio, design and testing capabilities, and reputation. We believe we generally compete favorably on the basis of these factors. However, some of our existing and potential competitors may have advantages over us. Many of our competitors are significantly larger in scale than we are and have access to greater financial, technical, marketing, and other resources. In most instances, competition among these vendors creates some level of pricing pressure and forces us to lower prices below our established list prices. Many direct competitors compete based upon price, and some high-volume Asia-based competitors are prepared to operate at less than 20% gross product margins.

Manufacturing and Operations

We outsource the manufacturing of our antenna products to two contract manufacturers, or CMs, located in China. We work with CMs to purchase raw materials, assemble, test, and ship our antenna products. We perform quality assurance and testing at our California facilities.

We maintain a close direct relationship with these manufacturers to help ensure supply and quality meet our requirements. Although the contract manufacturing services required to manufacture and assemble our products can be

18

satisfied by one of our CMs or may be readily available from several established manufacturers, it may be time consuming and costly to qualify and implement new contract manufacturer relationships. If our CMs suffer an interruption in their businesses, or experiences delays, disruptions, or quality control problems in their manufacturing operations, or we otherwise have to change or add additional contract manufacturers or suppliers, our ability to ship products to our customers could be delayed, and our business adversely affected. The CMs manufacture antenna products according to our design specification, materials specification, quality standards, and delivery requirements. We have full control and authority over the selection of materials, manufacturing processes, and inspection processes.

Research and Development

We invest considerable time and financial resources in research and development to enhance our antenna design and system integration capabilities, and conduct quality assurance testing to improve our technology. Our engineering team consists of engineers located in research, design, and test centers in California, the United Kingdom, China, and Taiwan. Our engineering team actively participates in research and development activities to expand our capabilities and target applications for the connected home market, adjacent in-home applications, connected vehicle, enterprise, and outdoor WLAN markets. We expect to continue to expand our product offerings and technology solutions in the future and to invest significantly in ongoing research and development efforts.

In the connected home, we are developing a series of antenna products for the home security market, including designs ranging from Z-Wave applications for door sensors to LTE designs for backhaul connections. We continue to architect and improve our antenna systems for our enterprise class smart antenna customers, as well as new high performance designs for the outdoor Wi-Fi and small cell markets. We are constantly reviewing alternative antenna designs for increasingly complex carrier gateway products, which are expanding beyond just delivering Wi-Fi to also include ZigBee, Z-Wave, DECT, and Bluetooth applications. Finally, we are engaged in the design and evaluation of antenna systems for next generation 802.11ac technology, including 8x8 reference designs.

Seasonality

Our operating results historically have not been subject to significant seasonal variations. However, our operating results are affected by how customers make purchasing decisions around local holidays in China. For example, a national holiday the first week of October in China may cause customers to purchase product in the third quarter ahead of their holiday season to account for higher volume requirements in the fourth quarter. In addition, although it is difficult to make broad generalizations, our sales tend to be lower in the first quarter of each year compared to other quarters due to the Chinese New Year. Results for any quarter may not be indicative of the results that may be achieved for the full fiscal year and these patterns may change as a result of general customer demand or product cycles.

Intellectual Property

We rely on patent, trademark, copyright and trade secret laws, confidentiality procedures, and contractual provisions to protect our technology. As of December 31, 2016, we had 69 issued U.S. patents covering our embedded and smart antenna technology with expiration dates ranging from 2020 to 2032, and 89 patent applications pending for examination in the United States. We also have 23 issued patents and 4 pending patent applications for examination in non-U.S. jurisdictions (Europe, China and Japan) with expiration dates ranging from 2020 to 2037, which entail counterparts of U.S. utility patent applications. The patents consist of several broad areas, as summarized by the following four patent groups:

|

|

• |

Methods of determining which antenna pattern to use; |

|

|

• |

Antenna pattern selection with multiple stations connected to access point; |

|

|

• |

Dynamically selected antennas for MIMO systems; and |

|

|

• |

Hardware implementations of switched directional antennas. |

Taken together, these patents with priority dates as far back as November 2000, form both a barrier to competition and a licensable asset for customers in the MIMO arena.

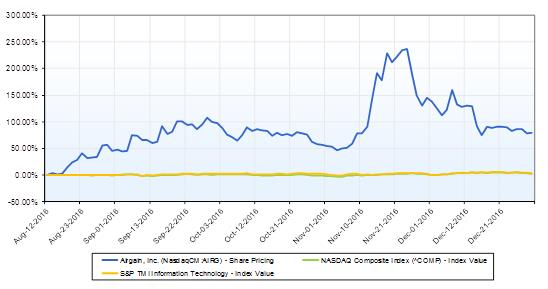

19